Home › Market News › Topstep Trading 101: The V Formation

The purpose of this series is to educate newer traders on the basic principles and techniques of technical analysis. To a lot of you, this is old news, but for the rest of you, we are here to help you build a solid foundation for identifying patterns on price charts.

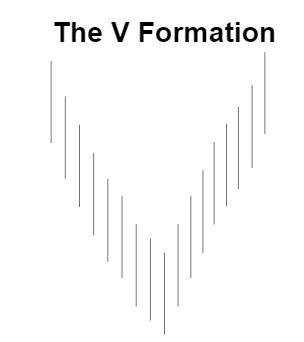

The V Formation is a fairly common reversal pattern and is widely considered the most difficult pattern to identify while it’s forming because of the swift and unpredictable trend reversal it produces. There are very few, if any, early warning signs to tip you off that a true reversal in trend is taking place. In fact, in nearly every circumstance, this pattern won’t be properly identified until after it’s full formation.

A few factors that set the V Formation apart from other reversal patterns is that the trend leading up to it is a strong one-direction movie, and there are no periods of price consolidation leading up to the reversal. This pattern is significant right now because of the recent Covid-19 related price action we’re seeing in the equity index futures markets.

The characteristics of the V Formation are the same for both tops and bottoms. There are a few pre-conditions that exist leading up to a V Formation, but they seldom help to identify any actionable trading opportunities.

When the left arm of a V bottom is forming you will see a noticeable increase in volume. This is mainly due to trapped longs liquidating or trying to reverse positions, which in turn produces a steep downtrend. The regularity of “limit price moves” during this period are very common, and make it extremely difficult to exit positions, adding further ‘fuel to the fire’.

Support and resistance levels hold very little significance while the V is forming, but identifying unfilled gaps on the downside may give a small indication as to how far the move down can potentially go before a reversal takes place.

The violent move lower is usually capped off by a key reversal price bar, which is immediately followed by a sharp move in the opposite direction. Because the move lower was so swift and steep, the violation of the down trendline on the subsequent move higher happens almost immediately, and therefore should not be used as confirmation of a change in trend.

If it’s a true V formation, then the right arm will retrace the full distance of the left arm, and a neckline can then be drawn to identify the breakout zone. From there, the price objective becomes the distance from the neckline to the trough measured upward from the breakout, with a stop just below the neckline.

More aggressive traders will use the ‘key reversal’ bar as a signal of trend reversal, and attempt a long position early on with a stop below the lowest price traded. Obviously, risk management plays a crucial role when trading this pattern more aggressively, because false signals of a bottom are also quite common.

Trade Well!