Top things to watch this week

The Economic Calendar:

MONDAY: Chicago Fed National Activity Index (7:30a CT)

TUESDAY: Building Permits (7:00a CT), Redbook (7:55a CST), S&P Global Composite PMI Flash (8:45a CT), New Home Sales (9:00a CT), Richmond Fed Manufacturing Index (9:00a CT), 2-Year Note Auction (12:00p CT)

WEDNESDAY: MBA Morgage Applications (6:00a CST), Durable Goods (7:30a CT), EIA Petroleum Status Report (9:30a CT), 5-Year Bond Auction (12:00p CT)

THURSDAY: Jobless Claims (7:30a CT), GDP (7:30a CT), Consumer Spending (7:30a CT), Retail Inventories (7:30a CT), Wholesale Inventories (7:30a CT), Pending Home Sales (9:00a CT), EIA Natural Gas Report (9:30a CT), Kansas Fed Manufacturing Index (10:00a CT), 7-Year Note Auction (12:00p CT)

FRIDAY: Personal Consumption Expenditures (7:30a CT), University of Michigan Consumer Sentiment (9:00a CT), Baker Hughes Rig Count (12:00p CT)

Key Events:

- Stock market nervousness and volatility about Middle East conflict.

- BTC halving happened on Saturday. Watch BTC price and miners (MARA, CORZ).

- Economic reports on GDP, PCE, Durable Goods, and Michigan Consumer Sentiment

- BOJ central bank meeting on Friday.

- U.S. PCE report (Fed’s favorite inflation data) on Friday.

- Earnings reports from Tesla, Meta, Google, Microsoft, Intel, Exxon Mobil & more.

STOCK INDEX FUTURES

The stock market’s April swoon continues, with the S&P 500 down -3.07% and the Nasdaq 100 -6.56% on the week.

The S&P 500 has exhibited a concerning trend for the past six days, with prices consistently opening higher before reversing course and closing near the day’s lows. This pattern suggests significant selling pressure emerging throughout the trading session.

Several factors may be contributing to this weakness. Firstly, large trend-following funds known as CTAs have been aggressively selling stocks, adding to the downward momentum. Additionally, investors will likely engage in risk hedging as economic uncertainties rise. Furthermore, tax-related outflows of a staggering $160 billion and stock outflows of around $25 billion are putting further downward pressure on the market.

This selling pressure has particularly impacted the leaders of Q1, namely tech and AI stocks, which were hit the hardest last week.

The below one-month performance summary of the S&P 500 highlights the sectors experiencing weakness compared to those showing some resilience. Finviz Heatmap below.

GEOPOLITICAL

Buckle up for a bumpy ride. Israel’s strike on Iran throws cold water on any hopes for a quick resolution in the Middle East. This tit-for-tat retaliation will likely drag on for weeks, keeping markets on edge.

Here’s what traders will likely be paying attention to:

- Expect volatility: Geopolitical uncertainty is bad news for stocks. Buckle up for wild swings as investors react to the latest headlines.

- Watch the oil price: The conflict could disrupt oil supplies from the region, sending energy prices soaring. This could hurt a broad range of stocks, especially transportation and manufacturing.

- Hedge your bets: Consider using options or other hedging strategies to protect your portfolio from a downturn.

- Stay informed: Monitor news developments in the region closely. How the situation unfolds will significantly impact the markets.

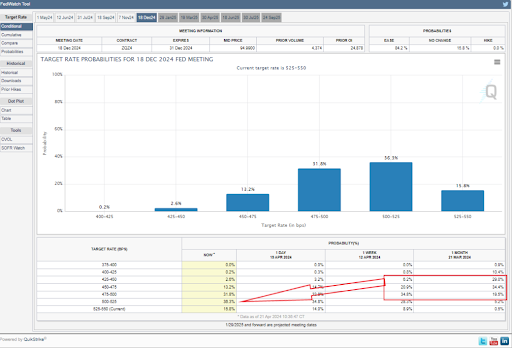

INTEREST RATE FUTURES

The probability of rate cuts in 2024 is dropping. December Fed Fund futures predict a 38% chance of a 25 basis point rate cut in 2024, down from the market’s prediction of a 75 basis point cut a month ago.

Recent Fed statements signal a more cautious approach to inflation and interest rates:

- Most Fed officials emphasize the need for a sustained decline in inflation before considering rate cuts.

- Chair Powell downplays the likelihood of cuts previously expected in 2024.

- The data-driven approach suggests the Fed will wait for clear signs of inflation receding before easing policy.

Despite strong economic indicators:

- Inflation remains stubborn, hindering progress towards the Fed’s 2% target.

- The labor market remains robust, potentially fueling inflationary pressures.

Source: CME Fedwatch

BITCOIN FUTURES

Bitcoin halving is complete, and price impact is awaited. Bitcoin successfully underwent its fourth halving event on Saturday, reducing miner rewards from 6.25 BTC to 3.125 BTC per block.

Crypto traders await potential price surges, with some forecasts reaching as high as $250,000. Bitcoin’s price currently sits around $65,000.

JAPANESE YEN FUTURES (CME)

The central bank will likely maintain its policy settings this week after its monumental policy shift at the last meeting in March. Traders will monitor this week’s central bank statement for clues on future policy and its tolerance regarding the recent JPY/USD weakness.

Trade Catalyst:

- Intervention risk in Yen is rising and is more likely as U.S. rates stabilize after a sharp sell-off.

Forecast Reward:

- Historical interventions resulted in 1-4% JPY appreciation within a week.

- Strong potential for short-covering by CTAs (heavily short JPY futures based on the CTA proxy model and COT report).

Risk:

- An unexpected hawkish shift by the Japanese central bank could further weaken JPY/USD.

- Intervention may not occur or have the desired effect.

Consider long JPY futures or options positions ahead of the central bank meeting and potential intervention.

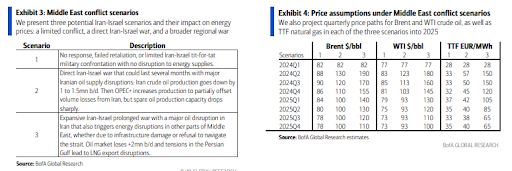

CRUDE OIL FUTURES

Oil prices are falling despite a Mideast conflict: Our traders break down the reasons WHY and provide an oil price scenario analysis (below from BoA Research).

- Oil prices dropped after Israel attacked Iran, a game of tit for tat.

- Oil prices dropped after Iran attacked Israel.

- Unlike usual spikes (low inventory, tight supply, production disruptions), the market is well-supplied.

- Traders believe:

- Iran won’t disrupt exports.

- The U.S. won’t want higher prices before elections.

- The U.S. will control Israel’s response.

- Inventories are near average, with ample spare production capacity.

- Oil prices are near long-term averages.

- The market was expecting tighter inventories but not a sustained price spike.

- OPEC+ may gradually increase production later in 2024.

- Global oil inventories are comfortable and able to handle short-term disruptions.

- OPEC+ has significant idle production capacity.

Source: BofA

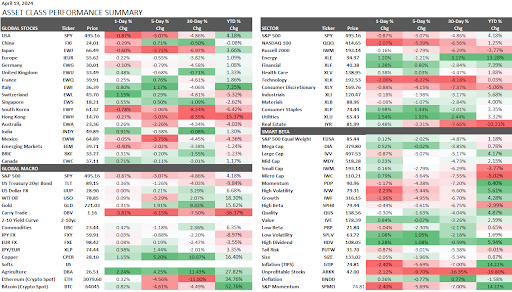

asset class performance sheet

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.

All content published and distributed by Topstep LLC and its affiliates (collectively, the “Company”) should be treated as general information only. None of the information provided by the Company or contained herein is intended as (a) investment advice, (b) an offer or solicitation of an offer to buy or sell, or (c) a recommendation, endorsement, or sponsorship of any security, Company, or fund. Testimonials appearing on the Company’s websites may not be representative of other clients or customers and is not a guarantee of future performance or success. Use of the information contained on the Company’s websites is at your own risk and the Company, and its partners, representatives, agents, employees, and contractors assume no responsibility or liability for any use or misuse of such information.

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the investor’s initial investment. Only risk capital—money that can be lost without jeopardizing one’s financial security or lifestyle—should be used for trading, and only those individuals with sufficient risk capital should consider trading. Nothing contained herein is a solicitation or an offer to buy or sell futures, options, or forex. Past performance is not necessarily indicative of future results.

CFTC Rule 4.41 – Hypothetical or Simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, because the trades have not actually been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.