Home › Market News › Updates on Stocks, Rates, and Crypto

The Economic Calendar:

MONDAY: Juneteenth Holiday: U.S. Markets Closed

TUESDAY: Housing Starts and Permits, 3-Month Bill Auction, 6-Month Bill Auction

WEDNESDAY: MBA Mortgage Applications, Jerome Powell Speaks, Lisa Cook Speaks, Philip Jefferson Speaks, 4-Month Bill Auction, Austan Goolsbee Speaks, 20-Yr Bond Auction, Loretta Mester Speaks

THURSDAY: Jobless Claims, Chicago Fed National Activity Index, Current Account, Existing Home Sales, Jerome Powell Speaks, Loretta Mester Speaks, Leading Indicators, EIA Natural Gas Report, EIA Petroleum Status Report, Kansas City Fed Manufacturing Index, 4-Week Bill Auction, 8-Week Bill Auction, 5-Yr TIPS Auction, Fed Balance Sheet

FRIDAY: PMI Composite Flash, Baker Hughes Rig Count, Loretta Mester Speaks

Futures Expiration and Rolls This Week:

The August (Q) contract is now the front-month Crude Oil futures. The July (N) contract will expire on Tuesday, July 20.

Key Events:

Stock indexes dropped briefly from 2023 highs but ended the week positively. The Nasdaq Composite had its eighth consecutive weekly gain, which hasn’t happened since early 2019.

The Fed’s decision to pause its interest-rate increases and data showing U.S. consumer confidence and spending is picking up seemed to buoy the market higher.

Traders are seeing the rally spread beyond tech stocks. Proof that the market thinks we’re avoiding an economic slowdown. For over a year, the Fed raised interest rates at the fastest pace since the early 1980s to fight inflation and slow the economy.

Some Wall Street banks are revising forecasts higher for stocks. Among the latest is Goldman Sachs, whose strategists raised their year-end S&P 500 target to 4,500 from 4,000, citing that the economy will likely avoid a downturn in the next 12 months.

Traders shrugged at Fed President Jerome Powell’s relatively hawkish rhetoric last Wednesday. Fed officials agreed unanimously to hold their benchmark federal funds rate in its current range between 5% and 5.25%

Dot plots were the surprise of the FOMC meeting. The terminal rate (highest rate) unexpectedly increased. Fed officials penciled in two more hikes later this year. 12 of 18 Fed officials expected to raise rates to fight inflation, up from four officials in March.

And during Powell’s press conference, he hinted that his current default position is to raise rates at the Feds’ July 25-26 meeting.

U.S. Treasury yields compared to the last week:

30-Year yield 3.88% vs. 3.88%

10-Year yield 3.74% vs. 3.69%

5-Year yield 3.91% vs. 3.84%

2-Year yield 4.60% vs. 4.50%

2-10 Yield spread -0.85% vs. -0.90%

Saudi Arabia failed to support crude oil prices as it moved to reduce crude output. Crude oil futures prices have fallen the past week and are now hovering near 2023 lows.

Traders are noticing better-than-expected production by sanctioned countries, including Russia and Iran, and fears of an international industrial slowdown that could slow growth in fuel demand.

Other signs of slowing are China’s post-pandemic recovery has shown signs of slowing. And in the U.S., where much of the economy has proven resilient, the Federal Reserve signaled the potential for more rate increases later this year to curb inflation.

BTC fell below support at $25,000 last week but has since rallied to $26,400 after Blackrock announced plans to launch a BTC ETF. The opaque regulatory environment has been the main driver of the falling prices.

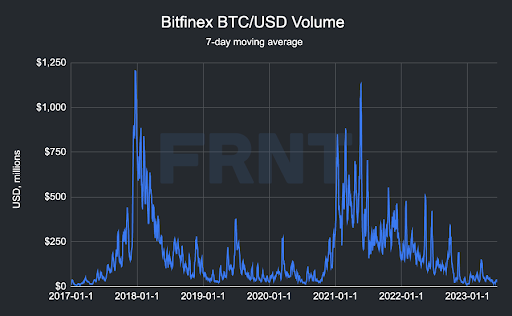

BTC trading volumes on the Bitfinex exchange remain subdued. In 2023 the average daily BTC/USD trading volume, so far, stands at $47 million. By comparison, in 2022 and 2021, BTC/USD average daily trading volume was $148 million and $397 million, respectively.

Source: FRNT Financial

The European Central Bank raised the key ECB interest rate by 25 basis points.

The European Central Bank raised its key interest rate by a quarter percentage point, pressing ahead with its campaign to fight high inflation.

The central bank has raised rates since July 2022 to bring down record-high inflation across the European region. The latest inflation reading showed prices slowing faster than expected, with headline inflation at 6.1% in May. This remains well above the ECB’s target of 2% inflation.

Traders have mixed views about what the ECB might do in the coming months.

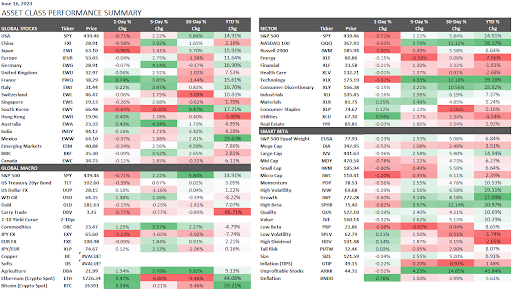

This performance chart tracks the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.

You will not win on all trades. Consistently profitable traders use mental discipline and follow system and risk rules. The confidence to follow these rules comes from testing the system rules repeatedly on hundreds of trades.