Home › Market News › Treasury Yields, Short-Term ES Levels, and the Crude Oil Bounce

The Economic Calendar:

MONDAY: Wholesale Inventories, 3-Month Bill Auction, 6-Month Bill Auction, Investor Movement Index

TUESDAY: NFIB Small Business Optimism Index, Philip Jefferson Speaks, John Williams Speaks, 3-Yr Note Auction

WEDNESDAY: MBA Mortgage Applications, CPI, Atlanta Fed Business Inflation Expectations, EIA Petroleum Status Report, 4-Month Bill Auction, 10-Yr Note Auction, Treasury Statement

THURSDAY: Jobless Claims, PPI-Final Demand, Christopher Waller Speaks, EIA Natural Gas Report, 4-Week Bill Auction, 8-Week Bill Auction, 30-Yr Bond Auction, Fed Balance Sheet

FRIDAY: Import and Export Prices, Consumer Sentiment, Baker Hughes Rig Count, James Bullard Speaks

Futures Expiration and Rolls This Week:

There are no expiration or rolls this week

Key Events:

Stock indexes were mixed for the week after a big Friday rally. The S&P 500 was lower -0.79% for the week, and the Nasdaq index was up only +0.10%.

On Wednesday, a ‘hawkish pause’ in FOMC guidance disappointed the dovish market. Stocks retreated after the FOMC meeting as Regional bank stocks fell under renewed pressure.

By Friday, the market tone had changed as Apple reported earnings better than expected, and bank stocks rebounded.

Volatility has subsided, and some traders are hedging the recent move and lower volatility in tech stocks by buying put options or selling stock and buying limited-risk call options.

A few key short-term levels for the S&P 500:

Upside: 4208,4220,4255,4280

Downside: 4125,4090,4080,4055

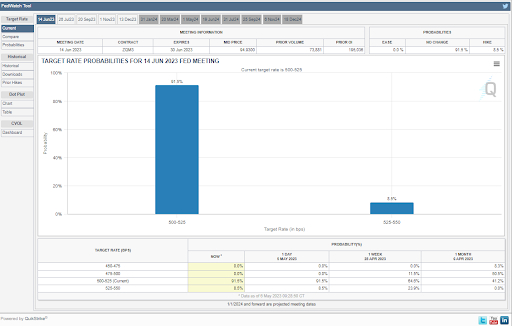

The Fed raised interest rates by 25 basis points as expected, signaling a possible pause in rate hikes soon. The current Fed Funds target rate is 5 – 5.25%.

Fed Chair Jerome Powell said that the central bank is prepared to do more if warranted and needs to keep options open. However, he added that the FOMC believes that inflation will need time to come down to the target of 2%. So, it is only appropriate to cut rates once inflation decreases significantly.

The Fed Fund futures markets are pricing in a 91% of no hike at the next Fed meeting on June 14.

U.S. Treasury yields compared to the last newsletter:

30-Year yield 3.75% vs. 3.67%

10-Year yield 3.44% vs. 3.42%

5-Year yield 3.41% vs. 3.48%

2-Year yield 3.92% vs. 4.00%

2-10 Yield spread -0.47 vs. -0.58%

Source: CME Group Fedwatch Tool

Source: CME Group Fedwatch Tool

Crude Oil futures bounced higher Thursday and Friday, putting up one the biggest up candles in a long time. Many oil traders have been getting stopped out of short-term strategy short positions as the market made lows and quickly reversed higher.

Short-term CTA trend followers are having a tough time in crude oil futures as their position went from max short to stopped out of the trade in 24 hours. These quick reversals typically lead trend followers to poor performance.

The core inflation rate is expected to rise 0.3% MoM – moderating slightly from +0.4% MoM in March – while the annual rate of core inflation is expected to remain unchanged at 5.6% YoY.

Credit Suisse economists say, ”Core goods inflation will increase, with higher used auto prices from Q1 showing up in the CPI this month. In contrast, inflation in other goods categories is expected to remain flat. Services inflation will remain high, with shelter inflation showing a slight decline in April but not expected to decline until later in the summer meaningfully.”

The Fed will still view inflation as too high despite the gradual disinflation over the past few months.

Central banks have been actively buying gold; some speculate this could spill over to Bitcoin buying.

Many have labeled Bitcoin as “Digital Gold” for its store of value and deflationary characteristics; others regard Bitcoin as the Gold of the 21st century as its portable and property rights can be easily protected – notably relative to any physical asset.

A regional banking crisis in the U.S. is also driving interest in Bitcoin as a store of value.

Bitcoin has a market capitalization of only $563 billion, which is only 5% of the gold market. Therefore, a small spillover from gold investors could create a parabolic move in Bitcoin’s price and perception as a store of value.

If one central bank takes the first step in buying Bitcoin as a store of value, other central banks could follow.

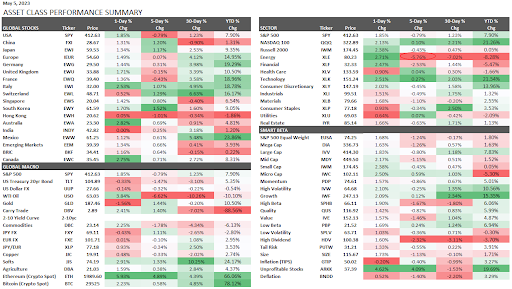

This performance chart tracks the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.

Independent thinking and forming your ideas and decisions are valuable tools in trading.

Take the recent comments in last week’s press conference by Fed Chair Powell: “The period of bank failures that have rattled markets and the economy has come to an end.”

Powell sought to reassure the public that the worst of the banking crisis was behind us, but a few hours later, the market called his bluff, and regional bank shares crashed.

The best thing you can do is form your ideas and not solely rely on news or others’ research.