Home › Market News › The US Dollar, Nat Gas Futures and Regional Bank Risks

The Economic Calendar:

MONDAY: PMI Composite Final (8:45a CST), ISM Services Index (9:00a CST), Vehicle Sales (9:00a CST), Rafael Bostic Speaks (1:00p CST)

TUESDAY: Redbook (7:55a CST), Total Household Debt (10:00a CST), Loretta Mester Speaks (11:00a CST)

WEDNESDAY: MBA Morgage Applications (6:00a CST), Balance of Trade (7:30a CST), Import & Export Prices (7:30a CST), EIA Petroleum Status Report (9:30a CST), Adriana Kugler Speaks (10:00a CST), Thomas Barkin Speaks (11:30a CST), 10-Year Note Auction (12:00p CST), Michelle Bowman Speaks (1:00p CST)

THURSDAY: Jobless Claims (7:30a CST), Wholesale Inventories (9:00a CST), EIA Natural Gas Report (9:30a CST), Thomas Barkin Speaks (11:05a CST), 30-Year Bond Auction (12:00p CST)

FRIDAY: CPI (9:00a CST), Baker Hughes Rig Count (12:00p CST)

Key Events:

JANUARY REHASH

The equity market sustained positive momentum throughout January, culminating in a favorable month-end performance for all major indices, each boasting gains exceeding 1%. The S&P 500 notably achieved a record-high close for five consecutive sessions, driven by optimism from robust economic indicators, expectations of lower interest rates, and bullish sentiment surrounding artificial intelligence.

Despite a lackluster final trading day prompted by the Federal Reserve’s decision to maintain interest rates, the overall gains in January were resilient. During the post-meeting conference, Federal Reserve Chair Jerome Powell tempered investor expectations for an imminent rate cut in March, leading to a downturn in equity markets.

On January 31, the Dow Jones Industrial Average experienced a 317-point decline, marking a 0.8% drop and its most significant single-day decrease since December. Similarly, the S&P 500 registered a 1.6% slide, marking its worst day since September, while the Nasdaq Composite recorded a 2.2% loss, its most significant daily decline since October.

Despite this setback, January proved to be a solid month for stocks, showcasing the market’s resilience in the face of short-term uncertainties. The positive trajectory observed throughout the month underscores the underlying strength and confidence in the equity markets, supported by favorable economic conditions and ongoing technological optimism.

These were the ten worst-performing S&P 500 stocks in January:

These were the ten best-performing S&P 500 stocks in January:

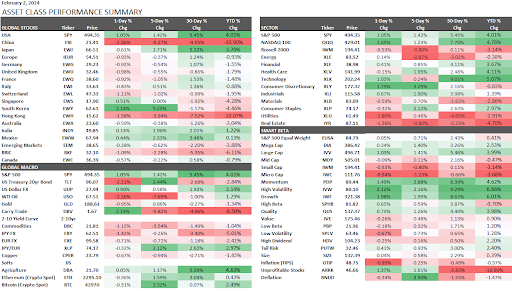

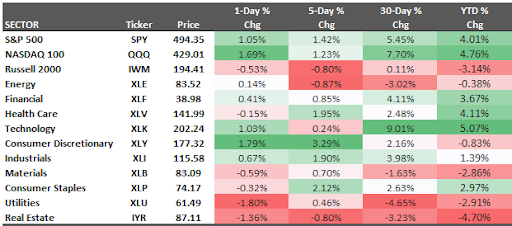

Returns thru 2/2/24

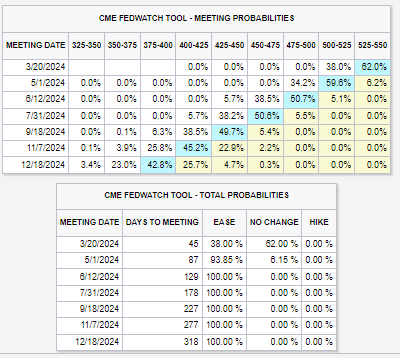

The rates market interpreted January FOMC communications as modestly hawkish.

The Fed has maintained the funds rate of 5.25% – 5.50%. This decision aligns with market expectations but throws cold water on the prospects of an early rate cut.

The Fed did not commit to imminent rate cuts, but it’s inching closer to that direction. The Committee dropped the language that previously left the door open for future hikes, signaling a potential shift toward rate reductions.

While some traders anticipated rate cuts as early as March, Powell hinted this might be unlikely. Yet some traders remain optimistic about a March cut.

A March rate cut is no longer the base case. Powell significantly raised the bar for a March cut by saying, “I don’t think it is likely that the committee will reach a level of confidence by the time of the March meeting” (to reduce the policy rate).

One View – based on the outcome of the January FOMC meeting, now look for the rate cut cycle to begin in June and expect 25bp rate cuts in June, September, and December. This would mean 75bp of rate cuts this year.

Source: CME Group Market Data

The lingering challenges in regional bank funding persist as CEOs opt for a reprieve rather than a resolution, banking on a potential decline in interest rates to facilitate property refinancing.

Despite the evident issues, some banks remain in denial, presenting real estate assets on their balance sheets at 100%, contrasting their actual market value of 50-70%.

The search for the clearing price of these assets becomes crucial in this uncertain scenario.

New York Community Bancorp, which experienced a substantial drop of over 44% before a partial recovery to a 38% decline on Wednesday, closed at $6.47, marking its worst day on record.

Notably, New York Community Bancorp had previously acquired assets from Signature Bank. This financial institution failed in 2023 amid a run-on effect triggered by California’s Silicon Valley Bank on regional banks.

In a captivating twist to the ongoing tech earnings season, industry giants Apple, Meta Platforms, and Amazon have collectively unveiled financial results that could induce palpitations in any trader.

Providing a contextual highlight, Meta Platforms, under the leadership of Mark Zuckerberg, accomplished a historic feat by adding a staggering $200 billion to its market capitalization in a single day—setting a new record for the largest single-day gain in stock market history.

The social media behemoth, renowned for its influential presence, has left market participants astounded with a jaw-dropping surge in revenue, reaching an impressive $40.1 billion.

Notably, Meta Platforms achieved a triple play by surpassing expectations in revenue, earnings per share (EPS), and raising its guidance.

The FX market likewise took the Fed’s message as hawkish, with the USD appreciating

broadly yet modestly on the statement release.

The FOMC press conference saw more 2-way price action until Chair Powell’s statement that the committee likely won’t be confident enough to cut in March lifted rates and added another leg higher in the USD.

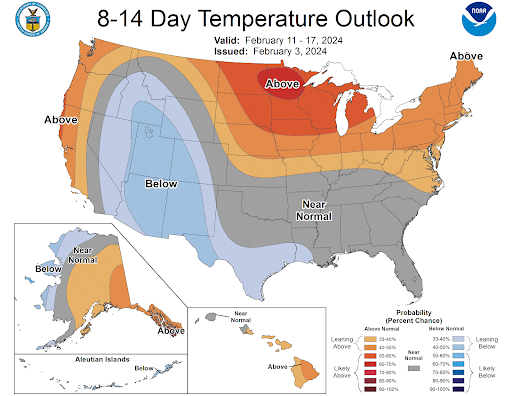

Natural gas prices are trying to recover on the possibility that we could get another blast of winter in a couple of weeks.

However, the 6-10 and 8-14day weather reports call for above or near-normal temperatures.

The selling of natural gas seems to have eased after the big spike after the polar vortex. Yet consumers in parts of the country will still be paying the price.

In Colorado, natural gas prices could be going Rocky Mountain high as Xcel Energy is asking to raise its base rate to sell natural gas by 9.5% because of the cost of Winter Storm Uri.

If we don’t see price increases for natural gas, many producers and providers will have big problems.

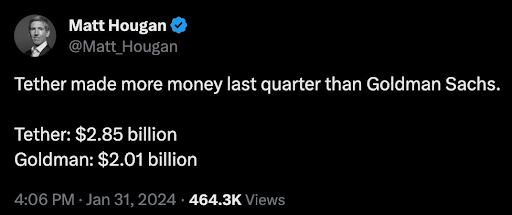

Stablecoin Tether is the best crypto business in the world. Even better than well-healed investment bank Goldman Sachs.

CEO of Tether Paolo Ardoino shared the following statistics about Tether’s Q4 performance:

Any business making $2.85 billion in profit during 90 days is hard to ignore. This puts them on a $11.4 billion annual run rate in profit. As Bitwise CIO Matt Hougan pointed out, Tether made more money than Goldman Sachs last quarter.

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.