Home › Market News › Super Bowl Metrics, Cocoa Demand, and the Nat Gas Price Dump

The Economic Calendar:

MONDAY: Michelle Bowman Speaks (8:20a CT), Consumer Inflation Expectations (10:00a CT), Neel Kashkari Speaks (12:00p CT), Monthly Budget Statement (1:00p CT)

TUESDAY: NFIB Business Optimism Index (5:00a CT), CPI (7:30a CT), Redbook (7:55a CST)

WEDNESDAY: MBA Morgage Applications (6:00a CST), Austan Goolsbee Speaks (8:30a CT), EIA Petroleum Status Report (9:30a CT), Michael Barr Speaks (3:00p CT)

THURSDAY: Jobless Claims (7:30a CST), Import & Export Prices (7:30a CT), Empire State Manufacturing Index (7:30a CT), Philly Fed Manufacturing Index (7:30a CT), Retail sales (7:30a CT), Industrial Production/Capacity Utilization (8:15a CT), Business Inventories (9:00a CT), NAHB Housing Market Index (9:00a CT), Retail Inventories (9:00a CT), EIA Natural Gas Report (9:30a CT), Christopher Waller Speaks (12:15p CT)

FRIDAY: Building Permits (7:30a CT), PPI (7:30a CT), Housing Starts (7:30a CT), Michael Barr Speaks (8:10a CT), University of Michigan Consumer Sentiment (9:00a CT), Mary Daly Speaks (11:10a CT), Baker Hughes Rig Count (12:00p CST)

Key Events:

The pressing question on traders’ minds is whether the stock market will maintain its upward trajectory or encounter a pullback.

S&P 500 futures, having recently breached the 5,000 milestone for the first time, appear poised to consolidate around this level, boasting a nearly 5% gain year-to-date.

Analysis of Q4 2023 earnings from over 500 companies through February 7th reveals a robust performance, with 72% reporting earnings per share (EPS) surpassing expectations. This exceeds the historical EPS “beat” rate of 65% over the past decade.

Stocks exceeding EPS estimates have experienced a notable rally, outpacing the typical post-earnings performance by approximately 50 basis points.

Looking ahead, the macro focus remains on Tuesday’s release of the January Consumer Price Index (CPI).

Federal Reserve Chair Jerome Powell has recently acknowledged the noteworthy easing of inflation but emphasized officials’ vigilance regarding associated risks to the dual mandate.

Powell cautioned against prematurely or excessively reducing policy restraint, highlighting the potential risk of reversing progress on inflation. He emphasized the need for greater confidence in the sustained downward trajectory of inflation, acknowledging the absence of a specified duration for achieving such confidence.

Despite expressing optimism, Powell remains cautious, emphasizing that ongoing progress is not guaranteed and any resurgence in inflation would be an unexpected development.

The Fed Fund futures are pricing a 16% chance of a 25 basis point rate cut in March, down from a 70% cut one month ago.

Source: Goldman Sachs

A Super Bowl commercial costs around $7M for a 30-second slot.

Viewership might also be subject to the “Taylor Swift effect,” with some predicting the total figure could top 118M, meaning the cost per impression would come in at just under $0.06 per viewer.

Betting wagers are expected to top $1.35B across the 39 regulated U.S. markets.

The anticipated scenario for the upcoming U.S. Consumer Price Index (CPI) release on Tuesday suggests a marginal uptick of +0.2% month-on-month (M/M) in headline CPI for January, consistent with the previous month’s figure. Concurrently, the core CPI measure is expected to show a similar increase of +0.3% M/M, mirroring the rate observed in December.

Traders are poised to interpret lower inflation readings as potential signals for the central bank to initiate interest rate cuts. Conversely, any price-pressure escalation will likely prompt traders to adopt a ‘higher for longer’ strategy.

Oil headed for a weekly advance after the U.S. killed the commander of an Iran-backed militia war and following Israel’s rejection of a ceasefire proposal from Hamas, dealing a blow to peace efforts to end the Gaza war.

The move of almost 6% last week has also been accompanied by gains in refining margins, indicating tighter fuel markets, and a surge in nearby gauges in the crude market that points to broader strength.

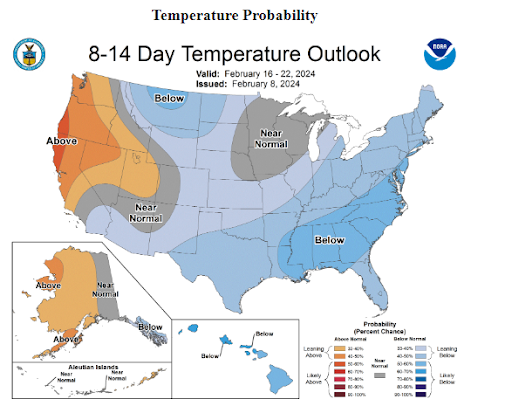

Natural gas futures have traded to the lowest prices in the last three years.

While strong technical and psychological support may stall declines, talks of near-term weather temperatures are returning to normal, and some weather models are calling for above-normal temperatures later this month.

Still, a pattern flip from record warmth to a chilly back half of February may offer chances for a relief rally. Early March could feature Arctic air masses—potentially sparking another short-covering rally higher later this month. Already, the front end of the curve flipped back into backwardation.

Traders should brace for the onset of “Candyflation” as cocoa prices surge to a 46-year high- May futures settled at $5599/per ton.

The existing cocoa production levels are insufficient to replenish stocks, leading to a looming global cocoa bean shortfall.

The primary drivers behind the upward trajectory in cocoa prices are diminished production and adverse weather conditions, notably drought.

Ivory Coast, the world’s largest cocoa producer, experienced a significant decline, with farmers shipping 1 million metric tons (MMT) of cocoa to ports from October 1 to January 28, marking a 36% decrease compared to the corresponding period last year.

The prevailing meteorological conditions exacerbate the situation, as Maxar Technologies’ meteorologist highlighted. Average temperatures in West Africa are currently 2 degrees Celsius above average, a trend expected to persist in the coming weeks.

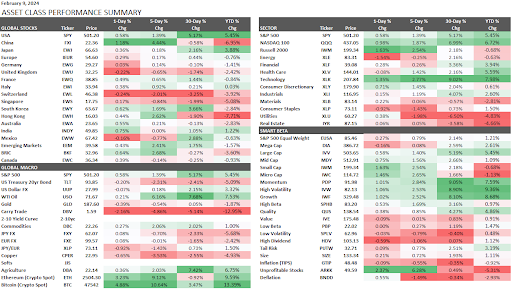

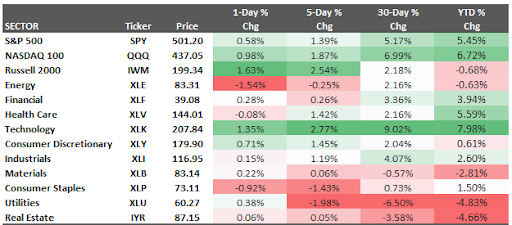

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.