Home › Market News › The Robinhooder’s Guide to Futures Trading

As usual, the financial media is lambasting millennials, but this time, they’re mad that millennials are finally dipping their toes into the stock market. Until recently, millennials have remained skeptical of markets, likely due to the pivotal role that the GFC played in their early lives.

Market pundits are unhappy with the nature of millennial involvement in the market. Instead of conservatively dollar-cost averaging Vanguard funds into their retirement portfolios, they’re trading microcap breakouts and COVID-19 vaccine stocks. Mobile broker Robinhood is usually their tool of choice.

While most of the strategies pursued by the Robinhooders have a negative expected value, their preference for fundamentals-agnostic short-term trading reflects their underlying skepticism of the traditional idea of investing and building for your retirement. Many of them take issue with the idea that the stock market is virtually guaranteed to yield 8% in the long-term, with only historical returns as evidence. The near-implosion of the system in 2008 was their introduction to the stock market, for many.

The name of this post is hyperbolic. Instead, it’s targeted at newer traders only familiar with stocks and options interested in learning more about financial markets and one of its most important products: futures.

It’s simultaneously the best and worst time to get into trading. On the one hand, in the past year or so alone, the CME launched micro futures, and the major stock brokerages cut their commissions to zero. Access to cutting-edge trading technology gets cheaper each year, and the cost of trading continues to decline, while retail-friendly products become increasingly available.

On the other hand, the new trader is assaulted from all angles by marketing hype, the glamorization of unreasonable financial risk-taking, and generally bad financial information on social media and elsewhere. As a new trader, it’s challenging to sort the good from the bad.

If you’re new to cooking, you don’t have a heuristic to judge recipes you find on the internet. Because you don’t know how to read a list of ingredients and see if they’ll yield a dish you like, you have to cook it and find out. As a new trader opening Google to find information, your experience is very much the same.

One of the first steps in getting out of this cycle of “cook it and find out” is to stop viewing sources of market commentary, which encourages unintelligent risk-taking like Barstool’s “Davey Day Trader,” who regularly proclaims ‘stocks only go up.’ Or Reddit’s WallStreetBets, which encourages traders to make highly leveraged bets that will leave them financially ruined should the bets fail.

The next is to read some of the standard financial markets books like A Random Walk Down Wall Street (although the author’s personal views on markets are controversial among traders) and Market Wizards. These books will give you a rough idea of what’s possible in trading and what it takes to get there.

Another crucial piece of knowledge is to understand that, while not entirely random, all financial markets have a high degree of randomness. Even the best trading system will frequently fail. A failure to respect risk is guaranteed to leave you with a blown-up account on any reasonable timeframe. Most professional traders risk between 0.25% to 2% of their trading account on each trade, depending on their style.

These figures vary drastically as you get into the nuts and bolts of trading. Still, as a general rule, technical traders risk a small portion of their account balance on any given trade because the probability of success on one trade, or even a set of trades, is subject to so much uncertainty.

Before we move on to learning about futures, consider this quote from Larry Hite, a hedge fund manager, and Market Wizard:

“Throughout my financial career, I have continually witnessed examples of other people that I have known being ruined by a failure to respect risk. If you don’t take a hard look at risk, it will take you.”

– Larry Hite

Futures are standardized contracts used to lock-in prices for future delivery dates. Futures contracts exist for commodities like crude oil, wheat, sugar, and financial instruments like equity indices and government treasuries.

These contracts represent an agreement between a buyer and seller to complete a transaction at a specified price on a specified date. At settlement (when the contract “expires”), the buyer takes delivery of the assets, and the seller makes delivery.

Examples of popular futures contracts are the E-mini S&P 500 (ticker: /ES) and Light Crude Oil (ticker: /CL).

Most traders and speculators opt not to deal with settlements and tend to either close or roll their positions before their settlement date. If you’re familiar with the options, this is similar to how you might have traded: closing or rolling your positions to the next expiration to avoid exercising options.

Futures markets are some of the world’s most actively traded markets. The E-mini S&P 500 regularly trades more than a million contracts per day, each contract holding a notional value of roughly $170,000 (updated September 14th, 2020).

Each participant in a futures market is either a hedger or a speculator. Hedgers have significant exposure to the underlying commodity or financial instrument, like a wheat farmer. A speculator is trying to profit from the price movements.

The primary distinction between these two market participants is that hedgers are trying to manage their risk, while speculators are voluntarily accepting risk.

As a simple example, consider a gold miner who is only profitable when gold prices are above $1000/ounce. If given the opportunity, they might sell gold futures at $1000 and above to lock-in profitability. Even though they risk the price of gold continuing to rise and missing out on profits, at least they lock in a profitable price.

Here are a few more examples:

On the other hand, a speculator is willingly putting their capital at risk in the hopes of profiting. Speculators are mixed bags; they can be anyone from retail day traders using technical patterns on the 15-minute chart to a hedge fund expressing their view on the long-term correlation between natural gas and crude oil.

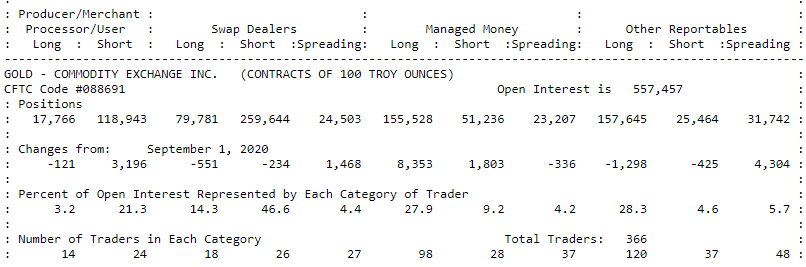

Each week, the Commodity Futures Trading Commission releases the Commitment of Traders report, which details which types of traders are long or short each contract, and their position size, as a group. These reports can serve as a sentiment indicator to tell you how certain types of traders are positioned.

Similarly, company executives’ insider buying is looked at as “smart money” in the stock market. Many take the same view regarding the position of the hedgers or “commercials” in the commodity futures market. Hedgers know the most about their industry, and their aggregate position is the most accurate representation of future prices, or so the theory goes.

Here’s an example of the September 8th, 2020 COT report for gold futures:

Larry Williams is one such trader who is famous for his use of the COT. But, many traders pay it little mind and instead focus on price action.

One of the more confusing aspects when approaching futures as a stock trader is how to size your positions. Looking at an /ES chart, you might see the number of $3400, but notice that each point is worth $50 in P&L?

Each futures contract has its notional value, which is typically a multiplier on the underlying asset. For example, the E-mini S&P 500 contract (/ES) is worth $50 times the index price. If the index is $3400, then the notional value is $170,000. The most popular crude oil contract (/CL) represents 1,000 barrels of crude oil. So if crude oil is trading at $40, then the notional value of a contract is $40,000.

This doesn’t mean that you need to pay the notional value to enter a futures contract. In fact, most brokers only require you to put up a small deposit, usually between 5% and 15%, to open a position. This is because the vast majority of traders never take or make delivery at settlement and instead trade in and out of positions.

When it comes to futures margin, there are three figures to keep in mind:

The initial margin is the amount of money you need to open a position, which varies from broker to broker. Interactive Brokers, for example, requires $13,200.09 in initial margin to open a position. Once you’ve opened a position, you’re subject to a maintenance margin.

Once you have established a position, your account balance must stay above the “maintenance margin,” which is usually slightly lower than the initial margin. Most exchanges set a minimum maintenance margin figure. Here are the CME’s minimum maintenance margin figures.

Each day, your P&L is marked-to-market and counted against your account balance. For example, if you have a $10,000 trading account and lost $1,000 in an open futures position, that loss would be reflected against your margin requirements at the end of the day.

Some brokers have separate margin figures for day traders, who open and close positions within a specified session. You have to be careful with day trade margins because each broker has its own rules. One broker might say if you open a day trade during the US “day” session, it needs to be closed before the night session, or you’ll be subject to maintenance margin requirements.

Day trade margins are typically significantly lower than maintenance margins, with figures as small as a few hundred dollars for large contracts like the S&P 500 futures.

Compared to stocks, futures’ margin requirements are flexible, allowing a small capital deposit for quick intraday scalps and requiring more capital as the trade length increases.

Open most popular technical trading books, and one of the more common axioms is that technical analysis tools are transferable to any market. That is, you can go from trading equity indices to illiquid microcap stocks to something even more foreign with the same tools. There’s an element of truth in this, but it’s worthless as a piece of trading advice.

The fact is that different asset classes have different tendencies. The most basic way to categorize this is in their price movement. Stocks, and even more so, stock indices (like the S&P 500 and NASDAQ 100) have a strong tendency towards retracing price extremes. This is known as mean reversion.

Currencies and commodities, on the other hand, are just the opposite. More often than not, a price extreme in one of these assets is followed by continuation in the same direction. This is roughly known as trend following.

In a nutshell, trend followers identify trends already underway and join them. As a result of their trading rules, they’re usually late to join trends and late to exit them. These trades usually last anywhere from weeks to years.

An entire money management industry revolves around trading trends in futures called commodity trading advisors (CTAs) or managed futures. The vast majority of these CTAs employ a trend following strategy.

If you want to trade futures, it’s imperative to understand how institutional-style trend following strategies work. Not because they’re the only way to make money in the futures markets, but because it’s such a popular strategy with billions of dollars behind it. Even if you don’t plan to trade in this style, understanding what works in your markets of choice is essential.

Look out for a post on trend following strategies in the coming weeks.

One of the defining characteristics of a Robinhood trader is a small trading account. According to 2018 data from JMP Securities, the average Robinhood account has between $1,000 and $5,000, compared to the Schwab or TD Ameritrade, with average account sizes of $110K and $240K.

The Robinhood trader’s small account undoubtedly plays a role in their pursuit of high-risk strategies and securities.

In the US stock market, there are strict regulations on how much margin one can utilize. In small accounts, that limit is generally 4:1 intraday and 2:1 overnight. Essentially, if you have a $2,000 account, you can trade with $8,000 intraday. However, this is even worse for Robinhooders, as Robinhood allows a maximum of 2:1 margin, regardless of your trading time frame.

Limited leverage in stocks isn’t necessarily a bad thing, as leverage quickly works against you. It’s skewed. If your position is winning, your broker generally won’t care. However, if you’re in a losing trade, your broker reserves the right to give you a margin call and force you to either close your position or deposit more money.

This is why understanding position sizing concerning the size of your total trading account is paramount. Leverage is only a good thing when it enables you to take intelligent risks.

Let me illustrate this with the stock market. For the sake of the example, assume this is your situation:

Let’s check out the chart of your typical blue-chip stock: Johnson & Johnson (JNJ). This stock has a pretty narrow range, even in thin markets. As you can see in the chart below, the Average True Range (ATR) is around $0.15 throughout the day. Two ATRs is a pretty standard stop-loss. Let’s construct a sample trade that risks 1% of a $10,000 account, with 2x the ATR as a stop-loss.

Most US brokers will only extend a $10,000 trading account with a 4:1 intraday margin, meaning you couldn’t execute this trade. Assuming this trading strategy has a positive expectancy (for reference: I pulled this example out of a hat to illustrate the point), this is a situation where the limited leverage in the US stock market is an inhibitor to intelligent trading.

The most liberal futures brokers allow you to access approximately $165,000 with just $400 of intraday margin. I’m referring to the E-mini S&P 500 contract (/ES), of which one contract is worth 50 times the price of the index. At a price, that makes one /ES contract worth $166,750.

This means that losing one point in an /ES position means -$50 in P&L. As you can see, it’s relatively easy for a trader with $400 in their account to blow up in one small trade. This is an example of unintelligent use of leverage.

Stock traders with less than $25,000 in their accounts are subject to FINRA’s pattern day trader designation. PDT designation restricts traders from making more than three-day trades during a rolling five business day period.

This designation does not apply to the futures markets. You can make as many intraday round trips as you’d like in the futures markets with any account size. Retail futures traders also benefit from the availability of day trade margins, which we discussed above.

As a basic rule, the major futures contracts are the most active markets for the underlying asset.

On any given day, the E-mini S&P 500 futures (/ES) will trade several times the dollar volume that the most popular equivalent ETF, SPY, trades.

The major futures contracts only trade on one exchange, which makes for a more transparent market. If you trade /ES, contracts only execute on the CME. Crude oil futures only trade on the NYMEX.

This seems like a meaningless distinction, but as you get into the practice of trading, it matters, especially if you trade based on order flow (analysis of the orders pending and executed in a market)

The difference couldn’t be more pronounced in the stock market. There are dozens of different exchanges, all with different fees and incentives and order-handling nuances. There’s also the problem of dark pools and internalization, which are another can of worms. While there are all types of tricks in both asset classes, estimating the amount of liquidity available for a stock is much more complicated than in the futures market.

Futures are designated as 1256 contracts in the IRS code. This means that 60% of your P&L is taxed as long-term capital gains, and 40% are taxed as short-term capital gains, regardless of holding period.

For active traders, this makes all the difference. Let’s imagine two traders, both filing as single.

Trader A trades stocks. He made $100,000 in trading profits this year, all from intraday stock trades. The IRS will tax him at a 24% rate, the short-term capital gains rate for his tax bracket. He’ll pay $24,000 in taxes this year.

Trader B trades futures. She also made $100,000 in trading profits this year, all from intraday futures trades. The IRS will tax 60% of her profits as long-term capital gains at a 15% rate, while the other 40% is taxed at the short-term capital gains rate for her bracket, which is 24%. She’ll pay $18,600 in taxes this year.

Futures contracts also are not subject to the wash sale rule, while stocks are.

These are two overly simplified situations, and remember, I’m not a CPA. I just got these figures from Investopedia. This is to illustrate how different the tax structure is between stocks and futures.

Perhaps this post has persuaded you that futures are an excellent instrument to trade. What’s next? Well, once you’re here, the journey never ends. Choosing an asset class or instrument is step zero.

To avoid laboring on forever, you need first to figure out how not to lose a lot of money, which is harder than it sounds. Depending on your preferred trading style, there are endless educational paths for you to take.

If you decide to be a technical trader, I highly suggest that you start by reading Adam Grimes’ The Art and Science of Technical Analysis. There are thousands of technical trading approaches, but I find Adam’s style to be a perfect balance of quantitative and qualitative.

The futures market is endlessly complex, but at the same time, you can make them as complex as you want them to be once you have done the necessary work to understand your market and develop a profitable system.

Many dedicate multi-decade careers to studying the plumbing of the futures markets and their idiosyncrasies. Others choose to look at a one-hour candlestick chart, look for one or two technical patterns, and call it a day. As Linda Raschke says, “you only need one pattern to make a living.”