Home › Market News › Rates, Crude Oil, & Bitcoin – What Are The Markets Doing This Week?

The Economic Calendar:

MONDAY: Thomas Barkin Speaks (11:50a CT), John Willions Speaks (12:00p CT)

TUESDAY: Redbook (7:55a CST), Used Car Prices (8:00a CT), RCM/TIPP Economic Optimism Outlook (9:00a CT), Neel Kashkari Speaks (10:30a CT), 3-Year Note Auction (12:00p CT)

WEDNESDAY: MBA Morgage Applications (6:00a CST), Philip Jefferson Speaks (10:00a CT), 10-Year Note Auction (12:00p CT), Lisa Cook Speaks (12:30p CT)

THURSDAY: Jobless Claims (7:30a CT), EIA Natural Gas Report (9:30a CT), 30-Year Bond Auction (12:00p CT)

FRIDAY: Michelle Bowman Speaks (8:00a CT), University of Michigan Consumer Sentiment (9:00a CT), Austan Goolsbee Speaks (11:45a CT), Baker Hughes Rig Count (12:00p CT), Michael Barr Speaks (12:30p CT)

Key Events:

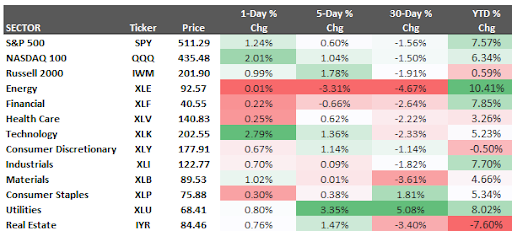

Bad news is good news, and the higher unemployment report on Friday saves stocks – for now. For the week, the S&P 500 rose +0.60% and the Nasdaq 100 +1.04%.

Stock market jitters are growing as inflation and rising interest rates dampen consumer sentiment. This is a potential sign that high inflation is finally impacting consumer spending power.

The Federal Reserve’s recent hawkish stance, indicating a possible pause on interest rate cuts, suggests further economic tightening ahead. While this might be necessary to curb inflation, it could also mean more financial strain for consumers, especially at the gas pump.

Recent earnings reports from consumer companies like Starbucks, DoorDash, Netflix, and eBay reveal a more troubling picture.

These companies all suffered double-digit stock price declines in the past few days, with executives citing a more cautious consumer base, increased price sensitivity, and uncertain economic outlooks. For example, Starbucks reported a 6% drop in customer traffic, reflecting a shift in consumer behavior.

Japan’s government has likely intervened in the currency market multiple times last week to strengthen the yen. This aggressive action, estimated to cost around ¥10 trillion ($80 billion), comes amid concerns from Japanese businesses struggling with the weak yen’s impact on planning and costs.

The government’s silence on the interventions and the potential involvement of the U.S. add further uncertainty to the situation. Traders are closely watching how effectively these measures will bolster the yen.

The news of intervention on May 2nd initially caused a brief rally in the USD/JPY futures pair, but a decline quickly followed it and then eventually moved higher, suggesting the market’s mixed reaction to these attempts.

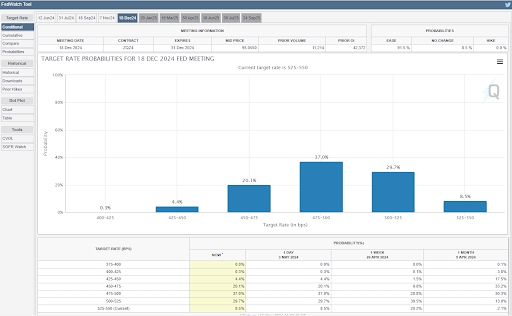

Traders actively watch this theme over the next few months. The major economies are on vastly different timelines for monetary policy, with a potential ECB rate cut in June contrasting with the Fed likely holding rates at 5.25% – 5.5% until Q4 2024. This divergence in response to inflation is poised to be a key trend this summer.

However, the Fed’s challenge lies in navigating economic data uncertainties. While rumors of an aggressively hawkish stance (raising rates sooner or faster) caused market selloffs, Friday’s unemployment report and plummeting consumer confidence data suggest the Fed might be overshooting.

The key for the Fed is to be data-dependent. Macroeconomic forecasting is inherently uncertain, and the Fed shouldn’t rely on pre-determined narratives. Instead, they need to move away from the recent “when will rates be cut?” messaging and acknowledge a two-way street – both the possibility of future cuts and, if data dictates, potential rate hikes. This will require a delicate balancing act, or “toeing the line,” to effectively combat inflation while avoiding unnecessary economic slowdown.

Source: CME Fedwatch

Bitcoin prices are slipping, but crypto ETF investors are feeling the heat.

Despite Bitcoin’s recent price drop (down 15% in April and 20% from its peak), outflows from Bitcoin ETFs haven’t been as dramatic as some might have expected.

While established players like Grayscale are experiencing outflows, which is typical, even BlackRock’s new iShares Bitcoin Trust (IBIT) saw its first day of investor selling.

This might have led some to believe that ETF investors are more risk-averse (“lettuce hands” in the text). However, the overall outflow picture suggests otherwise.

Bitcoin’s price volatility is likely to continue. Still, at least for now, it seems ETF holders are willing to weather the dips, indicating a potentially more resilient investor base in this space.

The oil market remains bullish in the long term despite recent price softness, which is due to concerns about a slowing global economy and a strong U.S. dollar (which typically puts downward pressure on oil prices).

Geopolitical tensions and a decline in new oil discoveries continue to support the potential for price increases.

Adding another layer of uncertainty, OPEC+ is considering extending its voluntary oil cuts beyond the second quarter (Q2) to prevent a global oil surplus and stabilize prices. While no formal talks have begun, sources indicate most market participants expect the cuts to be extended. The group’s official decision on June 1st regarding supply policy was whether to continue cutting down or gradually restoring production.

While these factors suggest a bullish long-term outlook, short-term headwinds exist. Talk of a sluggish global economy and a strong dollar are currently putting downward pressure on prices.

Additionally, U.S. oil production is expected to decline in 2024 due to decreased drilling activity.

Overall, the market is taking a wait-and-see approach, with long-term bullishness balanced against short-term economic uncertainties.

Goldman Sachs recommends an overweight commodity position. The thesis – this asset class offers diversification benefits, helping mitigate risks associated with geopolitical tensions and late-cycle overheating in the economy. Additionally, low inventory levels, supply deficits, and backwardation (a market condition where near-term prices are higher than future prices) should further bolster commodity performance.

While OPEC’s spare capacity may limit near-term oil price increases, Goldman Sachs’ commodities team maintains a rangebound view with a $90 per barrel ceiling on Brent crude. Geopolitical tensions in the Middle East could introduce volatility, but recent setbacks and high roll yields present an attractive entry point.

Despite its recent volatility due to easing geopolitical tensions, Goldman Sachs also sees value in gold. They maintain a year-end target of $2,700 per ounce, recognizing gold’s role as a hedge against geopolitical risks. Recent tailwinds include central bank purchases and rising Chinese demand.

The team is particularly bullish on copper ($12,000 per tonne target in 12 months) and aluminum ($2,700 per tonne target in 12 months). The global manufacturing uptick, the green transition push, structural under-supply, and extremely low inventories are all expected to drive demand for these metals.

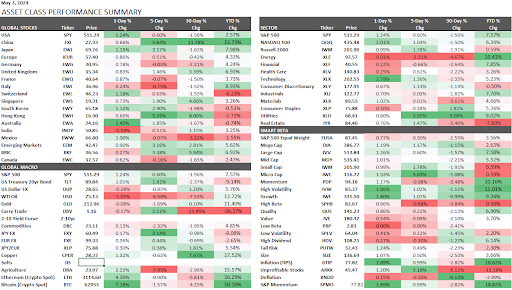

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.