Home › Market News › Rates, Crude Oil, and Bitcoin Futures

The Economic Calendar:

MONDAY: Chicago Fed National Activity Index, 3-Month Bill Auction, 6-Month Bill Auction

TUESDAY: PMI Composite Flash, Richmond Fed Manufacturing Index, 2-Yr Note Auction, Money Supply

WEDNESDAY: MBA Mortgage Applications, New Home Sales, State Street Investor Confidence Index, EIA Petroleum Status Report, Survey of Business Uncertainty, 4-Month Bill Auction, 2-Yr FRN Note Auction, 5-Yr Note Auction

THURSDAY: Durable Goods Orders, GDP, International Trade in Goods, Jobless Claims, Retail Inventories, Wholesale Inventories, Pending Home Sales Index, EIA Natural Gas Report, Kansas City Fed Manufacturing Index, 4-Week Bill Auction, 8-Week Bill Auction, 7-Yr Note Auction, Fed Balance Sheet

FRIDAY: Personal Income and Outlays, Consumer Sentiment, Baker Hughes Rig Count

Key Events:

Stocks had a tough week and ended lower. For the week, the S&P slipped -2.39%, and the Nasdaq 100 closed down -2.9%.

Traders are concerned that Israel’s conflict with Hamas could escalate into a wider Middle East war. Also adding to the gloomy tone were long-term interest rates climbing and hotter-than-expected retail sales data.

The only positive sectors on the week were Energy +0.75% and Consumer Staples +0.70%.

The worst-performing sectors for the week were Real Estate -4.3%, Consumer Discretionary -4.58%, and Financials -3.04%.

TradingView

A contrarian view:

The decision-making process of Federal Reserve officials appears unlikely to undergo any significant changes in the near future. Fed governors are compelled to make decisions based on historical data, which, in turn, relies on their perception of the present reality.

It is highly improbable that the Federal Reserve, or virtually any other participant in the financial markets, could accurately articulate the current state of the economy and foresee developments over the next 6-12 months.

Adding to the complexity is the rapid increase in the U.S. national debt, amounting to hundreds of billions of dollars per month. This raises the possibility of the Federal Reserve resorting to substantial quantitative easing to better manage this debt’s monetization.

Moreover, it’s worth noting that this assessment does not even factor in potential future monetary support for countries like Israel or Taiwan.

The oil options skew has gone massively inverted. In plain English, upside out-of-the-money call volatility is relatively more expensive than at-the-money options. Oil options markets show traders are more interested in calls, call spreads, and short put structures.

One way to take advantage of this pricing “anomaly” if you are bullish on oil is via call spreads (where the sold leg is relatively more expensive in terms of volatility).

Short-term risk indicates a rise in prices in the upcoming days and weeks. If the conflict intensifies or expands, the price increase might be sustained longer-term.

Source: Goldman Sachs

Source: Zerohedge, Alpine Research

The market tells traders what could happen when the SEC greenlights the BTC spot ETF.

Bitcoin jumped to nearly $30,000 last Monday, gaining around $2,000 in a matter of minutes after crypto news outlet Coin Telegraph said on social media platform X (formerly Twitter) that the SEC had approved BlackRock’s spot bitcoin ETF application.

The rumor proved to be untrue, and Bitcoin quickly fell back down. The current spot price is around USD 29,400.

Savvy traders will want to keep 11/17/23, and 1/10/24 circled on their calendars as deadlines for SEC action to approve (or not) BTC ETF.

Source: Bloomberg

The consensus expects the ECB to have no rate change on all three key rates. The expectation for unchanged rates has stemmed from the September policy statement, which noted that the rates “have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.”

Big Oil players have increasingly turned to the Permian Basin for oil and gas, where technological advancements and infrastructure have led to lower extraction costs. In the last few weeks, the trend has been for companies to join together in mergers.

U.S. natural gas producer Chesapeake Energy Corp has approached Southwestern Energy in a potential $12bn deal. Should the two companies combine, they would overtake EQT Corp as the U.S.’s largest natural gas-focused exploration and production company by market value.

ExxonMobil (XOM)’s $60 billion acquisition of Pioneer Natural Resources (PXD) highlights Big Oil’s continued appetite for shale producers. It gives ExxonMobil massive scale in the Permian Basin, allowing it to double its footprint in the largest oil-producing region in the U.S. and strengthen its upstream portfolio. Upstream refers to the initial oil and gas production phases, like exploration, drilling, and extraction.

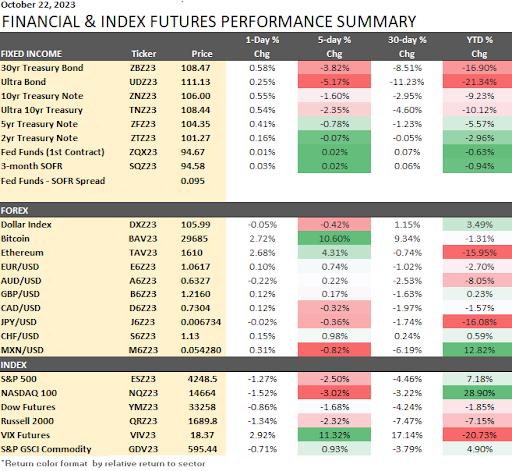

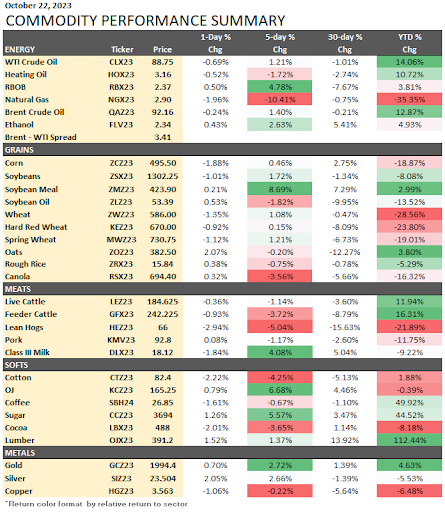

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.