Home › Market News › Rates, Commodities, and AI Stocks Picking Up Steam

The Economic Calendar:

MONDAY: Leading Economic Indicators (9:00a CST)

TUESDAY: Redbook (7:55a CST), Richmond Fed Manufacturing Index (9:00a CST), 2-Year Note Auction (12:00p CST)

WEDNESDAY: MBA Mortgage Applications (6:00a CST), PMI Composite Flash (8:45a CST), EIA Petroleum Status Report (9:30a CST), 5-Year Note Auction (12:00p CST)

THURSDAY: Building Permits (7:00a CST), Jobless Claims (7:30a CST), Durable Goods (7:30a CST), GDP (7:30a CST), Consumer Spending (7:30a CST), Retail Inventories (7:30a CST), Wholesale Inventories (7:30a CST), New Home Sales (9:00a CST), EIA Natural Gas Report (9:30a CST), KC Fed Manufacturing Index (10:00a CST)

FRIDAY: Personal Consumption Expenditures (7:30a CST), Pending Home Sales (9:00a CST), Baker Hughes Rig Count (12:00p CST)

Key Events:

The U.S. GDP report is on Thursday. The Q4 GDP is expected to show 2.0% growth, easing from the Q3 growth of 4.9%, with current analyst forecasts ranging between 1.3-2.8%.

For GDP, the Atlanta Fed GDPNow estimate is tracking Q4 growth at 2.4%, above the 2.0% analyst consensus.

Traders will also watch the PCE and Core PCE prints to gauge price action in the fourth quarter 23.

The consensus is for U.S. core PCE to rise +0.2% month over month in December. WSJ Fed watcher Nick Timiraos says that, based on the CPI and PPI data for December, core PCE is projected to have been mild last month.

If the data is in line with expectations, the annual rate of PCE would fall to 2.9% from 3.2%.

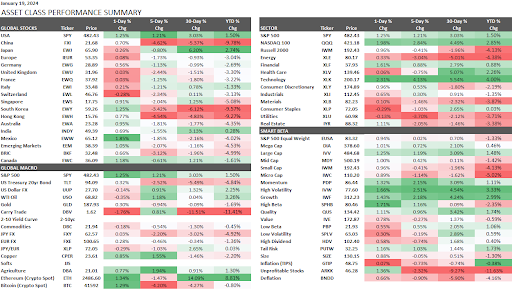

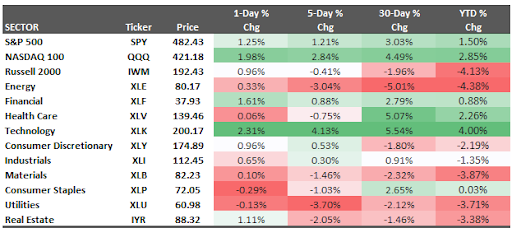

The S&P 500 ended the week higher by +1.2%, and the Nasdaq-100 finished up +2.8%.

Tech stocks continue to lead the market in 2024 +4%, as Russell 2000 and Energy stocks lag YTD -4.1% and -4.3%.

One possible risk is that earnings-call mentions of “Red Sea” surged to record highs in recent weeks as the fourth-quarter earnings season kicks off.

Management teams and analysts are apprehensive about shipping disruptions as major shippers suspend sails through the critical waterway. At the same time, U.S. and allied forces unleashed bombing raids on Iran-backed Houthis in Yemen.

AI stocks are the hottest trade around. We are starting to hear, “The froth is beginning to dissipate as businesses focus on real-world uses rather than pie-in-the-sky applications.” The one theme we hear is Microsoft Copilot could be where the broader public increasingly sees the benefits first in 2024 with AI assistance for analyzing, charting, and editing Office 365 documents and catching up on meetings and messages.

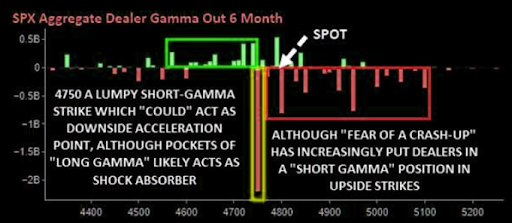

Watch ES 4750 on the downside for the huge option gamma flip and cascade lower zone.

Source: Nomura

Traders wonder if they’ve jumped the gun on interest rate cut speculation.

It’s essential to watch for the PCE print, scheduled for release this Friday.

The probability of a rate cut by March, as indicated by Federal Reserve Fed Fund futures, dipped to 46%, down from nearly 76% one week ago. This shift triggered an uptick in treasury yields and the dollar.

Federal Reserve governor Christopher Waller’s remarks, signaling a measured approach to rate cuts, triggered some market turbulence, with 2- and 30-year Treasury yields surging as high as 4.22% and 4.3%, respectively—an increase of 8 and 10 basis points on the day of the speech.

Addressing the Brookings Institution, Waller conveyed that the Fed is on the cusp of attaining its 2% inflation target. However, he urged caution, emphasizing that any inclination towards rate reductions must be executed with precision and diligence.

Waller suggested that a reasonable initiation of rate cuts could be considered “sometime this year,” proposing three cuts, contrary to market expectations of five to six. While not overtly aggressive, Waller’s comments did not lean significantly towards leniency, prompting a reassessment of interest rate expectations.

Wells Fargo aligns with a restrained Fed approach, projecting three cuts throughout 2024. This trajectory would position the Federal funds rate between 4.50% and 4.75%. It’s essential to note that these forecasts are subject to change, emphasizing the importance of data over verbal indications in the ongoing battle against inflation.

Source: CME Group and QuikStrike

Snippets from some analysts in the commodity market at the beginning of the year:

What is our most bullish commodities call in 2024?

Gold. We expect bullion to hit a new record in 2024, with our forecast at USD2,350/oz by year-end, owing to a trifecta of Fed cuts, supportive central bank demand, and its role as the geopolitical hedge of last resort. On net, we recommend leaning long gold and viewing any sell-off as a buying opportunity in an environment with elevated risk dimensions (geopolitics, recession repricing), which play into gold’s favorable hedging qualities.

What is our most bearish commodities call in 2024?

Natural gas – both in the US and EU. Despite the recent weather-related rally for the US, the combination of warmer-than-average weather in the current winter season (resulting in heating demand destruction) and stronger-than-expected gas production has softened US gas balances (despite overall strength observed across gas demand). From mid-2025 onwards, the tide could be turned by a wave of new LNG terminals positioned to start consuming feed gas, but for 2024 the story is one of oversupply in the US natural gas market.

JPY/USD has weakened in FX markets since the start of 2024, and CTAs were forced to cut losses on JPY/USD long positions.

As CTAs have essentially completed adjusting their positions, we expect an even stronger tendency to wait by the sidelines.

JPY/USD and JPY/EUR are driven mainly by shifts in investor expectations for Fed and ECB monetary policy in 2024. Traders overestimate the rate cuts these central banks will undertake in 2024, so there are downside risks for USD/JPY and EUR/JPY.

Nevertheless, we recommend a mean reversion strategy on the recent move lower in JPY/USD.

A new trading indicator to watch as the market on close flows influences BTC futures.

Because the ETF will cause U.S.-listed ETF derivatives volumes to surge, the 4 pm EST print of the CF Benchmark index will become very important. A derivative derives its value from the underlying.

With soon-to-be billions of dollars of options and futures expiring daily vs. the ETF’s closing traded price, matching the NAV is essential.

This will create statistically significant trading behavior on and around 4 pm EST vs. the rest of the trading day. Those of you who are good with datasets and have good trading bots will earn huge monies arbitraging these market inefficiencies.

Steve Hanke’s 95% rule: 95% of what you read in the press is either WRONG or IRRELEVANT.

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.