Home › Market News › Meet Chicago Funded Trader Rob M

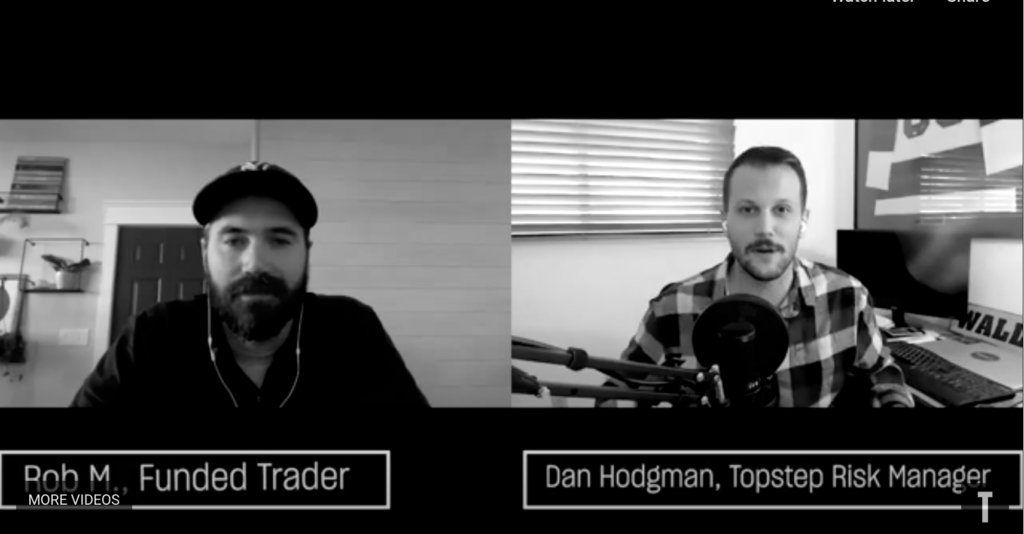

Originally from South Jersey, Funded Trader Rob M, now of Chicago, has been with Topstep for a little over a year. His experience as a hobby trader, dating back to 2009, led him to search for a respectable funding opportunity and his discovery of Topstep. He recently sat down with Topstep Performance Coach Dan Hodgman to talk a little bit about his trading style and his experience with Topstep so far.

While going through his evaluation in the Trading Combine, Rob bounced around between products until he found the ones that best suit his trading style. Choosing the right product to trade is important for three reasons.

In Rob’s case, he was looking for a smaller equity index product and a slower moving treasury product with a bigger contract size that trades counter to equities. One of the products he eventually landed on is the Ultra Bond, where he can take advantage of the larger tick size along with slightly wider ranges than the 30-year bond, but not quite as volatile as the 10-year note. Points for style, Rob!

We know many of you would like to jump right in and start trying to catch the big swings in the Nasdaq, but it pays off down the road to do a little research on which market will be best for your trading style.

When it comes to finding entry and exit levels, Rob isn’t trying to reinvent the wheel. His approach is practical. First, he tracks performance, starting with longer timeframes and then moves down the line to shorter timeframes. Then, he waits for market generated information to give him insight in real-time. Based on those insights, he’s then able to formulate his support and resistance levels for the day.

As far as his frequency of trades goes, he’s not looking to do a hundred round turns a day. By slowing things down and taking 3-4 highly probable and well thought out trades a day, Rob has learned to appreciate the fine art of being patient and waiting for the setups to come to him.

Rob credits his time spent in performance coaching sessions with the way he has fine-tuned his trading over the past year. He also learned that taking a “simpler is better” approach to markets has cut down on the clutter and overload of having too many indicators and oscillators clogging up his charts. Doing away with the information you don’t find useful can help paint a much clearer picture than you might have imagined.

Also, learning to trade for yourself instead of using someone else’s technique produces a greater sense of accountability, accomplishment, and empowerment to develop and build your strategies.

Rob has figured out the reason why professional traders never actually retire from trading. He says that when you develop better trading habits by managing risk and not losing money every day, you create an organic approach to trading that will sustain you for the long-term, no matter how much money you have when you start.

Rob’s story is a refreshing one to start the year. As we continue to focus on our traders’ development, the insights Rob shares in this interview are something every trader can mimic, no matter your experience or skill level.

Trade Well!