Home › Market News › Learn to Trade the Open (Every Day has One!)

There are a variety of ways that traders daily approach the opening range of a market. Some strategies utilize the first print of the session as a pivot, while others wait for the instrument to make a high and low over a period such as fifteen minutes or an hour.

There are several ways to use these ranges. The first typical pattern is the breakout. Once a high or low is established, this strategy will then look to buy when the price exceeds the high or short when the low is broken. The premise of this strategy is that markets often experience higher momentum and volume in the early part of the day; therefore, when a range breaks, there is a reasonable enough chance that the market will begin to trend.

Below is an example of the Euro vs. Great Britain pound (EUR/GBP). These are five-minute bars, with the first-hour range shaded in a square. The orange line is the low of the first hour. You will find that once price broke the low, there was sizable momentum to substantiate this move. If a trader shorted the break of the low using a stop that was the halfway mark of the established range (shown by the dotted line), not only would the stop-loss have been untouched, but it also reflects a desirable return potential on modest risk.

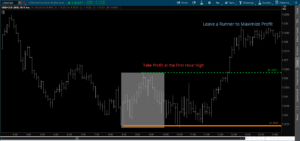

Another way a trader might use the first-hour range is as support and resistance. Take this example shown below of the U.S. dollar against the Canadian dollar (USD/CAD). The initial range is shown in the grey box with the low of day marked by the orange line. If the trader bought this pair at the 10:30 retest of that low and held for a move back to the upper part of the range, that would have been a satisfying trade. However, if the trader scaled out of half of their size when the market returned to the top of the range, leaving on the other half to climb, then this trade becomes even more beneficial.

One advantage of forex trading is the wide availability of global markets from New Zealand and Australia that open around 17:00 – 18:00 EST, to Japan that opens 19:00 – 21:00 to Europe opening around 2:00 am and then North America around 8:30 – 9:30 am. In other words, there are multiple potential opportunities each day to identify successful trades based on the opening ranges.

Each trader can take these high/low levels and adapt them to fit their trading style while utilizing multiple indicators to assist in higher profitability, such as your favorite momentum indicators or overbought/oversold oscillators.

If there is one trick, then it is this. These markets are open 24/5, meaning they never actually close during the trading week. So when I use the open, I am referring to when business hours begin in these various parts of the world. More specifically, when the financial markets start and economic indicators are released. These will determine how each market opens.

Take, for example, the United States, where the local currency correlates to the stock market that opens at 9:30 EST and U.S. Treasury markets opening at 8:20 EST. It requires homework to decide when to detect your market open. On days when there are minimal economic releases, the U.S. dollar might remain quiet until the stock market opens at 9:30. On those days, I will assess a later open. In contrast, there are other days when crucial economic reports available at 8:30 am ensure that the dollar will move early. On these days, I calculate an earlier open.

Determining the open is not complicated, but it does require awareness of when financial markets open in that particular region as well as homework that determines when to expect the relevant economic reports of that day.

Trading the open is popular because it benefits from the highest volume of the day. Many traders also prefer it because the specified time frame permits traders to structure work and leisure accordingly. However, one also must consider that higher volume times are also likely to be more volatile. The essential characteristic of any trading strategy is managing risk appropriately.

If you have experience trading the open, please leave a comment on strategies you have found to be useful. Or if you would like to learn more, ask a question below.