Home › Market News › Interest Rates, Tax Loss Harvesting, & A BIG Bond Trade!

Top things to watch this week

Top things to watch this weekThe Economic Calendar:

MONDAY: Dallas Fed Manufacturing Survey, 3-Month Bill Auction, 6-Month Bill Auction

TUESDAY: FOMC Meeting Begins, Employment Cost Index, Case-Shiller Home Price Index, FHFA House Price Index, Chicago PMI, Consumer Confidence, 52-Week Bill Auction, Farm Prices

WEDNESDAY: MBA Mortgage Applications, ADP Employment Report, Treasury Refunding Announcement, PMI Manufacturing Final, ISM Manufacturing Index, Construction Spending, JOLTS, EIA Petroleum Status Report, 4-Month Bill Auction, FOMC Announcement, Fed Chair Press Conference

THURSDAY: Motor Vehicle Sales, Challenger Job-Cut Report, Jobless Claims, Productivity and Costs, Factory Orders, EIA Natural Gas Report, 4-Week Bill Auction, 8-Week Bill Auction, Fed Balance Sheet

FRIDAY: Michael Barr Speaks, Employment Situation, PMI Composite, ISM Services Index, Baker Hughes Rig Count

Key Events:

The market is relatively confident the FOMC will leave rates unchanged at 5.25-5.50% on Wednesday. The probability of no rate change is over 99%.

Traders will focus instead on guidance for the December meeting. Jawboning Fed officials are of the opinion that the Fed is done with rate hikes, with the central bank “proceeding carefully” to let cumulative tightening continue to work through as inflation trends lower and the labor market adjusts.

However, the latest economic growth resurgence in Q3 is keeping tail risk skewed to further hikes in the near term (20% hike probability priced for December currently).

Below, see the probabilities of the December meeting. Traders also pushed out the pricing of the first full 25bp rate cut back to July 2024, with doves (who are the only ones to pose the topic of easing) noting any rate cuts wouldn’t be until late next year.

Source: CME Fedwatch

Who’s Buying All The Bonds? With Treasury bills yielding more than 5% and 10-year Treasuries yielding around 4.9%, these are some of the highest yields in decades.

Yields continue to climb as the market searches for investors to take duration risk.

In the chart below, notice the net purchases of all Treasury securities across a range of investor groups.

Through the end of Q2 (the latest data available), households and non-profit institutions had purchased $673bn more UST debt this year than they had sold.

That’s more than twice the pace of the next-fastest buyer of Treasury bonds. Foreign investors have bought more than $300bn in Treasuries.

Source: Bespoke

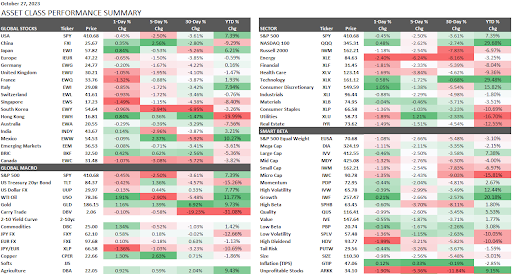

The S&P 500 retreated last week by -2.50%, and the Nasdaq-100 was lower by -2.62%.

Micro-cap stocks have been hit the hardest, down -9.03% for the month and -15.81% YTD.

The trade that has been working from Nomura’s Charles McElliot:

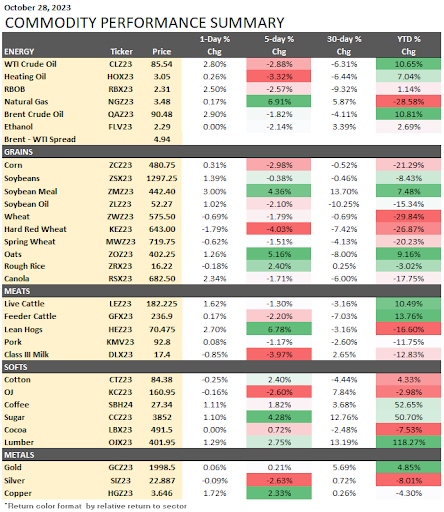

The weakest sectors last week were Energy -6.24% and Healthcare -3.84%. The Utility sector was the only positive last week, +1.21%.

Ongoing hostage negotiations and the delay of Israel’s ground invasion did technical damage to the oil charts.

Many oil analysts argue that the possibility of a recession and historical Israelian conflicts are keeping oil prices in a tug-of-war trading range.

We continue to use upside option structures (call spreads) to express views.

The imminent risk to the oil supply could heat up as ground forces became more aggressive over the weekend. The risk to supply is still there with the possibility of cracking down on Iran’s oil with sanctions.

JPM’s oil analyst writes that oil is around $7 overvalued at current levels: “Since 1967, ex-1973 Yom Kippur War, none of the ten major military conflicts involving Israel induced a lasting impact on oil prices. When a major oil producer has been involved in a military conflict, oil has traded up $7 – $14.”

Bitcoin has undergone four bull market cycles, each driven by a distinct narrative.

This bull market officially commenced in June 2023.

The BoJ’s expected rate policy announcement is on October 31. The meeting comes at a time of volatility in Japanese financial markets as the 10-year JGB yield is around 85bps, and USD/JPY rose above 150.00.

The BoJ resorted to unscheduled bond operations, rumored FX intervention, and Japanese official’s abundance of jawboning.

The BoJ rate and forward guidance are expected to be maintained, but there is growing speculation that a change to yield curve control could be announced.

Bill Ackman will let you know through media when he does something good.

Billionaire hedge fund manager Bill Ackman made a profit of about $200 million from his short bet on the US 30-year Treasury bonds. The founder of Pershing Square Capital Management said on social media last Monday that he exited the short position he first announced in August.

His post helped fuel a recovery rally in Treasury futures after an earlier sell-off had pushed yields to 16-year highs.

Mutual funds tend to harvest equity losses for tax purposes before their typical fiscal year ends on October 31st. This will likely put further selling pressure on the S&P 500’s major laggards over the next few days.

Many traders are compiling a list of the S&P’s ten worst YTD performers. These will act as potential tax loss candidates that could bounce starting in November as mutual fund tax loss selling abates.

DYOR (Do Your Own Research) – four of these names were watching – ENPH, MRNA, FMC, and EL.

Remember – Individual investors/traders now have until December 31 to harvest tax losses.

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.