Home › Market News › Interest Rates, Bank Defaults, and This Week’s Economic Data

The Economic Calendar:

MONDAY: 3-Month Bill Auction, 6-Month Bill Auction

TUESDAY: NFIB Small Business Optimism Index, CPI, Quarterly Services Survey

WEDNESDAY: MBA Mortgage Applications, PPI, Retail Sales, Empire State Manufacturing Index, Business Inventories, Housing Market Index, Atlanta Fed Business Inflation Expectations, EIA Petroleum Status Report, 4-Month Bill Auction, Treasury International Capital

THURSDAY: Housing Starts and Permits, Jobless Claims, Philadelphia Fed Manufacturing Index, Import and Export Prices, EIA Natural Gas Report, 4-Week Bill Auction, 8-Week Bill Auction, Fed Balance Sheet

FRIDAY: Industrial Production, Consumer Sentiment, Leading Indicators, Baker Hughes Rig Count

Futures Expiration and Rolls This Week:

MONDAY: Equity Index Futures roll from March (H) to June (M)

Key Events:

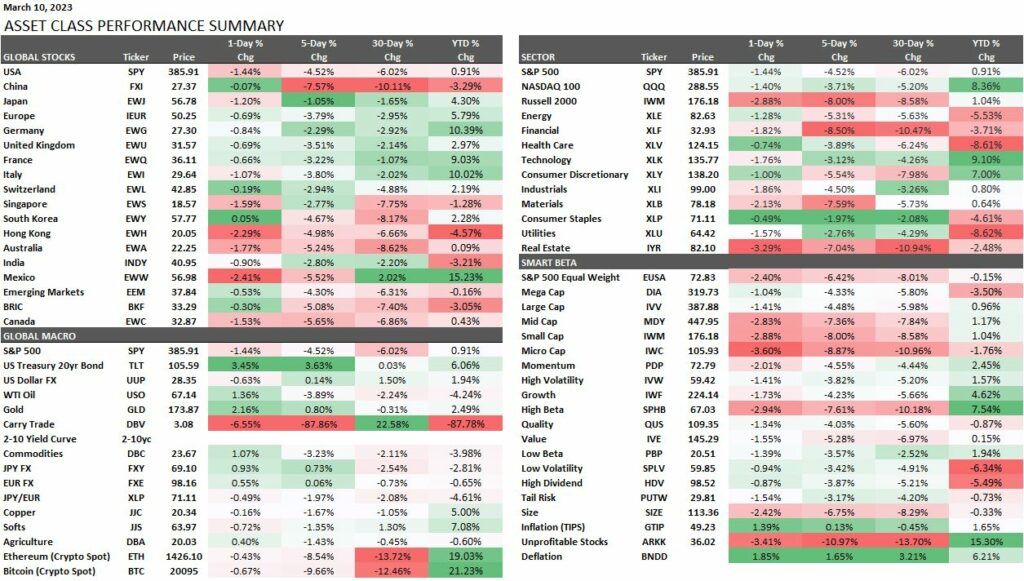

Risk happens slowly and then all at once. Stocks ended their worst week this year with a fourth straight day of losses. The S&P 500 and Nasdaq tanked -4.5% and -3.7% on the week. The financial sector (XLF) was the weakest and off -8.5%.

Is the banking liquidity crisis an isolated incident or the tip of “an iceberg”? Let’s recall:

A few key short-term levels for the S&P 500:

Upside: 3955, 3995, 4040

Downside: 3862, 3847, 3800, 3755, 3690

Before the recent bank liquidity crisis, there was talk about the possibility that the Federal Open Markets Committee (FOMC) federal funds rate could exceed 6% in the future.

Treasury futures soared on a flight to quality move on Thursday and Friday. According to the CME Fed Watch tool, the probability of a 50 basis hike at next week’s meeting is 58%. The stat was as high as 80% early in the week before subsiding.

Last week, U.S. Non-Farm Payrolls in February rose more than expected (311k vs. Exp. 200k) while a broad measure of monthly wage growth slowed, offering a mixed picture as the Federal Reserve decides whether to step up the pace of interest rate hikes.

Tuesday’s U.S. CPI report is now more critical than ever, and the outcome will probably determine between a 25 or 50 basis point rate hike.

Next week’s FOMC meeting and any reaction to the recent banking liquidity crisis are highly anticipated.

U.S. Treasury yields current yield compared to the last newsletter:

30-Year yield 3.71% vs. 3.87%

10-Year yield 3.70% vs. 3.95%

5-Year yield 3.97% vs. 4.24%

2-Year yield 4.59% vs. 4.85%

2-10 Yield spread -0.89% vs. -0.89

Summing up the latest bank liquidity crisis – Silicon Valley Bank (SVB) failed with $200 billion in 24 hours, and Silvergate Bank failed on over $11 billion over the last few weeks.

Thousands of companies who borrowed and took loans from SVB were required to keep their cash in SVB. Those entrepreneurs, their employees, and vendors are scrambling now and hoping for some white knight acquisition or Federal backstop.

The irony is that the V.C. “community” started the SVB run on Thursday when it urged its portfolio companies to pull their deposits from SVB, which they did in the amount of $42 billion. And now they want the taxpayers or the Fed to bail out their investments.

Economist Jim Bianco sums it up best:

“This is not a solvency crisis like 2008. Bad loans or poor investments were not made. Money was not lost. So, everyone is going to get their money back. (And please, no takes about no interest rate hedging. Asset/liability mismatches are how banking works.)

Instead, this is an old fashion 1930s liquidity crisis. Too many depositors demanded cash at once (as of right now), and SVB (and S.I.) could not convert loans and securities (and crypto) to cash that quickly. So, everyone is getting their money back from SVB (and S.I.), just not at 8 AM Monday.

This should scare the hell of bankers and regulators worldwide. The entire $17 trillion deposit base is now on a hair trigger expecting instant liquidity. “

Managing risk is integral to any business, whether a start-up or 100 yrs old.

The FDIC rules didn’t change bank rules recently. Bad decisions or lack of attention need to be met with negative consequences. It’s the only way to make sure people learn and get better.

As traders, careful attention to possible risks and risk management lets us play the game long-term. The market price action, as crazy and illogical as it might be, dictates that sometimes we need to take the hit/loss to survive. The market is the market – ADAPT.

A coordinated attack on crypto fiat banking payment rails rhymes with the past dismemberment of internet gambling operations. There is a deliberate attempt to sever the links between the traditional banking system and the crypto economy. Great read from Doomberg on that here.

In the last months:

Suspension of USD bank transfers notably by Binance on February 8 and Bybit on March 10.

Closure of Silvergate’s Exchange Network (SEN) on March 4.

Signature Bank, another bank close to the crypto sector, had informed their crypto exchange customers that SWIFT payment transfers of less than $100,000 would no longer be supported as of February 1, 2023.

Silicon Valley Bank client Circle, who controls stablecoin USDC, has deposits at the bank.

The founding concept of Bitcoin was to create an alternative financial system. Some have even argued that crypto does not need banks; crypto should be “bankless”. But without the ability to channel fiat currency into the crypto world, crypto looks more like a “zombie” than any form of innovation.

This performance chart tracks the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.

Reflecting on this message after the last few trading days.