Home › Market News › Gold Futures, Interest Rates, and a Looming Government Shutdown

The Economic Calendar:

MONDAY: Lisa Cook Speaks, 3-Month Bill Auction, 6-Month Bill Auction, Treasury Statement

TUESDAY: John Williams Speaks, Philip Jefferson Speaks, NFIB Optimism Index, Consumer Price Index (CPI), Michael Barr Speaks, Austan Goolsbee Speaks

WEDNESDAY: Producer Price Index (PPI), U.S. Retail Sales, Empire State Manufacturing Survey, John Williams Speaks, Business Inventories, Michael Barr Speaks, Tom Barkin Speaks

THURSDAY: Michael Barr Speaks, Jobless Claims, Import Price Index, Philly Fed Manufacturing Survey, Loretta Mester Speaks, Industrial Production/Capacity Utilization, John Williams Speaks, Home Builder Confidence Index, Christopher Waller Speaks, Michael Barr Speaks, Lisa Cook Speaks, Susan Collins Speaks

FRIDAY: Housing Starts, Building Permits, Susan Collins Speaks, Michael Barr Speaks, Austan Goolsbee Speaks, Mary Daly Speaks

Key Events:

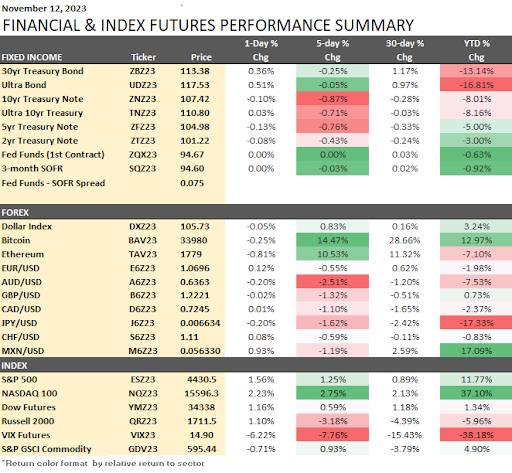

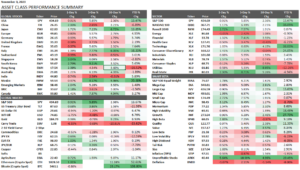

A massive rally on Friday lifted stocks higher for the week. The S&P 500 futures closed at 4430.50 (+1.25%/week) and the Nasdaq-100 at 15,596, +2.75% for the week.

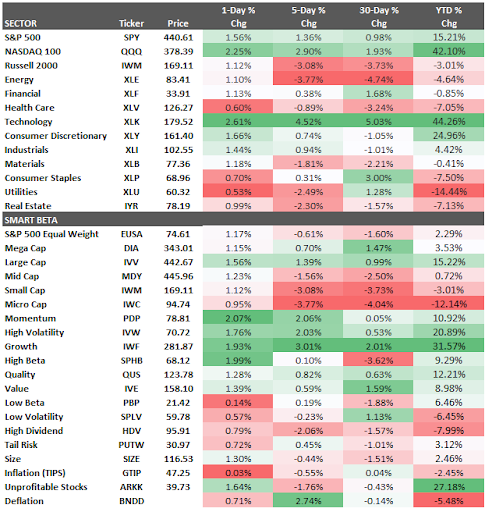

What stands out is the laggard performance in Russell 2000 and S&P 500 equal weight indexes. Both were lower on the week: -3.08% and -0.61%

Sectors and smart beta were mixed on the week:

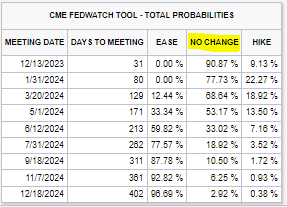

The Fed Funds futures markets are predicting no further rate rises through mid-2024, and 65 basis points of cuts are now seen by the end of 2024.

Source: CME Fedwatch

There was little change in that basic market pricing after Powell spoke last week, with end-2024 futures still pointing at a rate of 4.50-4.75% versus the current 5.25-5.50%.

Last week, Chair Powell guided a cautious approach to policy. He said officials were committed to achieving a stance of monetary policy that is sufficiently restrictive to bring inflation down to 2% over time.

The FOMC is not yet confident that it has achieved such a stance. If officials feel it is appropriate to tighten policy further, they should be quick to do so, noting that ongoing progress toward the target was not assured. Inflation readings have recently given “a few head fakes.”

Core CPI is expected to rise 0.3% month over month (MoM) in October, matching the rate seen in September, while the annual rate of core inflation is also seen unchanged, at 4.1% year over year.

The October data is likely to have been driven by stable energy prices and possible declines in vehicle prices, as high borrowing costs reduce consumer demand.

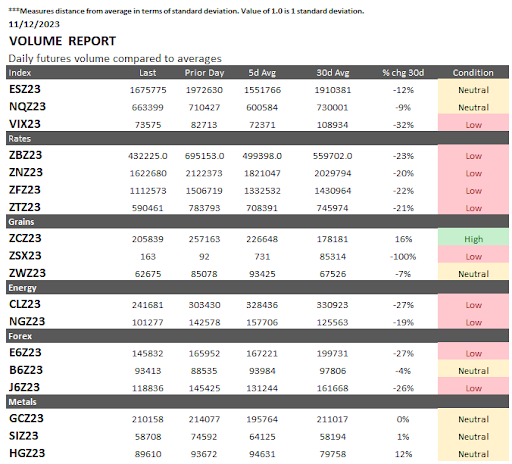

The poor demand at last week’s 30-year Treasury market auction caused yields to spike higher.

At the government debt auction, traders were awarded 4.769% in yield, 0.051 percentage points higher than the yield in pre-auction trading.

Two-year Treasury yields jumped more than ten basis points on the day to more than 5%, with 10, and 30-year yields jumping 12bps to 4.65% and 4.77%, respectively.

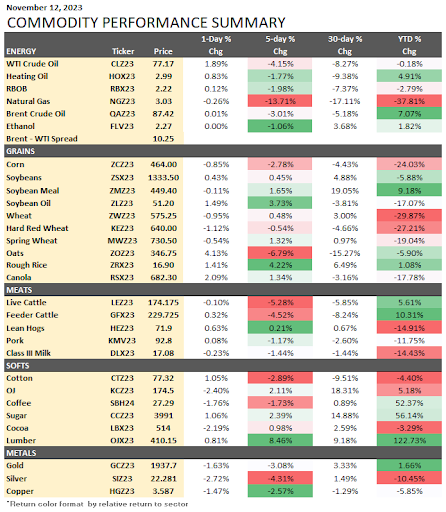

Gold faces a weekly fall in price as traders ditch the Middle East war hedge. Gold futures closed at $1937.7 on Friday.

Trend following CTAs were short futures into the initial recent move higher after the Hamas-Israel conflict started and were forced to cover at highs. The CTA crowd then was triggered long and is now either stopped out or neutral as of Friday.

Gold volatility has come down since the panic highs two weeks ago. Some traders are playing the downside in gold via options. The GLD Dec 188/177 put spread offered around 4X max payout, or playing outright long puts looks attractive as the skew is relatively low.

The U.S. government is set to face another shutdown this Friday. The GOP-majority House and Democratic-majority Senate have a week to agree on a stopgap.

The House could vote on a plan on Tuesday. However, the House is struggling to agree on a detailed spending plan. Like the prior budget showdown, some Republicans call for spending cuts that the Democrats will likely reject.

The odds are likely to see stopgap funding for another month to mid-December.

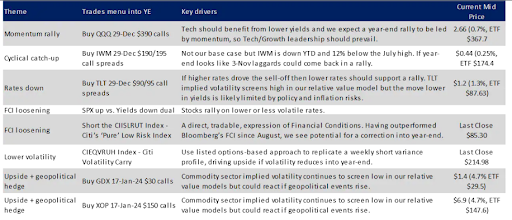

Source: Citi

Crude Oil futures continue to drop on the perception that the Chinese economy has hit stagnation, raising the risk of a global recession. WTI settled at $77.16 on Friday.

Most quant CTAs are positioned short futures, and macro players still lean long futures on the war premium.

There are rumors that players in the Middle East are distancing themselves from Hamas, thereby reducing the risk of a regional war. Also, there is talk of backchannel U.S. negotiators to call for a settlement agreement to the Ukraine-Russia war.

OPEC even vowed to take appropriate measures at the next meeting. Saudi Arabia, as expected, announced it will extend its 1 million barrel of oil a day production cut into December and most likely beyond.

Bitcoin (BTC) holdings have risen to the highest ever alongside the token’s continuing rally, thanks partly to optimism about coming approval for a spot exchange-traded fund.

Shorts are getting nervous as Bitcoin’s price stubbornly refuses to go down on weekends when institutions aren’t trading on the CME.

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.