Home › Market News › Gold, Crypto, and a Short Trading Week

The Economic Calendar:

MONDAY: Memorial Day Holiday – U.S. Markets CLOSED

TUESDAY: House Price Index (8:00a CT), Case-Shiller Home Price Index (8:00a CT), Neel Kashkari Speaks (8:55a CT), Consumer Confidence (9:00a CT), Dallas Fed Manufacturing Index (9:30a CT), 2-Year Note Auction (10:30a CT), 5-Year Note Auction (12:00p CT), Lisa Cook Speaks (12:05p CT), Mary Daly Speaks (12:05p CT)

WEDNESDAY: MBA Mortgage Applications (6:00a CT), Redbook (7:55a CT), Richmond Fed Manufacturing Index (9:00a CT), 7-Year Note Auction (12:00p CT), John Williams Speaks (12:45p CT), Fed Beige Book (1:00p CT)

THURSDAY: Jobless Claims (7:30a CT), Corporate Profits QoQ (7:30a CT), GDP (7:30a CT), Consumer Spending (7:30a CT), Retail/Wholesale Inventories (7:30a CT), Pending Home Sales (9:00a CT), EIA Natural Gas Report (9:30a CT), EIA Petroleum Status Report (10:00a CT), John Williams Speaks EIA Natural Gas Report (11:05a CT)

FRIDAY: Personal Consumption Expenditures (7:30a CT), Chicago PMI (8:45a CT), Baker Hughes Rig count (12:00p CT)

Key Events:

Traders are looking for the Fed’s favorite inflation gauge, the PCE Index, to offer clues on the pace of future interest rate moves.

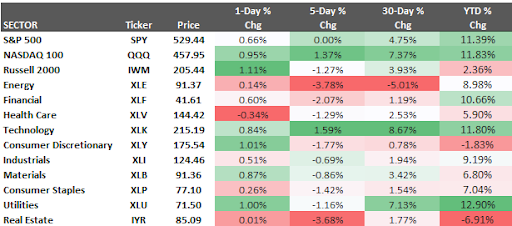

Stock index futures continue to show positive optimism. The S&P 500 finished a bit higher last week, by +0.02%, and the Nasdaq 100, by +1.37%.

In a surprising turn of events, Morgan Stanley CIO Mike Wilson, previously one of Wall Street’s most vocal bears, has significantly revised his outlook on the stock market. This shift marks a major development, potentially signaling a broader trend.

Wilson, known for his cautious stance, dramatically raised his S&P 500 price target to 5,400 by Q2 2025. This represents a significant increase from his prior prediction of a plunge to 4,500 by year-end 2024.

Takeaways:

The Federal Reserve painted a clear picture last week: interest rates will likely stay high for the foreseeable future. This hawkish message sent shockwaves through the market, impacting everything from bond yields to commodity prices.

Federal Reserve officials, including Cleveland Fed President Loretta Mester, signaled a shift away from previous expectations of rate cuts. Rising inflation data has forced them to reassess the situation. As Mester stated, “We just need to collect more information on that” before considering a looser monetary policy.

This hawkish stance sent tremors through the Treasury market. Yields on two-year notes climbed significantly, narrowing the gap between them and ten-year yields. This “bear-flattening” of the yield curve often precedes recessions, but its reliability in this unique economic cycle is questionable (see below).

Some analysts also take a political lean called “The Trump WIldcard,” suggesting a potential rate increase might be more likely if Donald Trump were elected president. This adds another layer of uncertainty to the already volatile rates market environment.

Gold prices tumbled last week, experiencing their worst two-day drop in a month and the steepest weekly decline of the year. This reversal was caused by a strengthening dollar and hawkish signals from the Federal Reserve.

The catalyst for the selloff was the release of the FOMC meeting minutes last Wednesday. These minutes revealed concerns among Fed officials regarding persistent inflation. While some members expressed confidence that disinflation would eventually occur, others worried about its pace.

The oil market is preparing for the June 2 OPEC meeting, which OPEC decided to hold online rather than in person.

Traders are focusing on whether or not OPEC will extend production cuts into 2025. Most likely, since an online meeting, traders have expected OPEC to continue on its current path.

Amena Bakr points out, “commitment among the OPEC+ alliance to the cuts is strong, and countries that have been overproducing their quotas are compensating for the increased volumes.” So, OPEC may do whatever it takes to keep the oil market tight, and if demand surges, the supply deficit will occur.

The past two weeks have been a whirlwind for crypto, culminating in the long-awaited approval of spot Ethereum ETFs. This decision marks a significant shift in the regulatory landscape and presents a major opportunity for the asset class.

Crypto’s just made a political pivot. Previously viewed with skepticism by many politicians and regulators, crypto gained unexpected political relevance. Donald Trump’s pro-crypto stance at a recent NFT event appears to have spurred a reevaluation from President Biden and the Democratic party. This political pressure, coupled with the success of Bitcoin ETFs, likely played a role in the SEC’s U-turn decision to fast-track the approval of the ETF.

Rumors that the SEC is potentially reversing its stance on ETH ETFs have sent shockwaves through the crypto community. This, combined with Fidelity’s surprise withdrawal from staking, fueled speculation and market volatility.

Looking ahead, the approval of ETH ETFs opens the door for a new wave of crypto investors to enter the Ethereum ecosystem. This will likely significantly impact the price and adoption of ETH. However, the full implications of this decision are still unfolding.

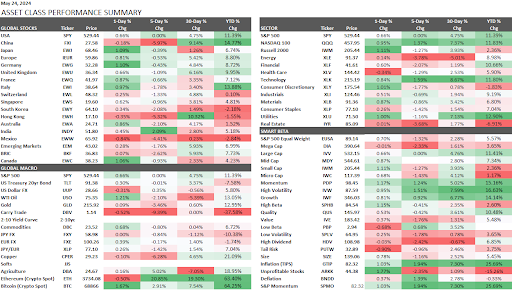

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.