Home › Market News › Geopolitics, Crypto News, and an Update On Asset Performance

The Economic Calendar:

MONDAY: PMI Manufacturing, ISM Manufacturing Index, Construction Spending, 3-Month Bill Auction, 6-Month Bill Auction

TUESDAY: Motor Vehicle Sales, JOLTS, 52-Week Bill Auction

WEDNESDAY: MBA Mortgage Applications, ADP Employment Report, PMI Composite, Factory Orders, ISM Services Index, EIA Petroleum Status Report, 4-Month Bill Auction

THURSDAY: Challenger Job-Cut Report, International Trade in Goods and Services, Jobless Claims, EIA Natural Gas Report, 4-Week Bill Auction, 8-Week Bill Auction, Fed Balance Sheet

FRIDAY: Employment Situation, Baker Hughes Rig Count, Consumer Credit

Key Events:

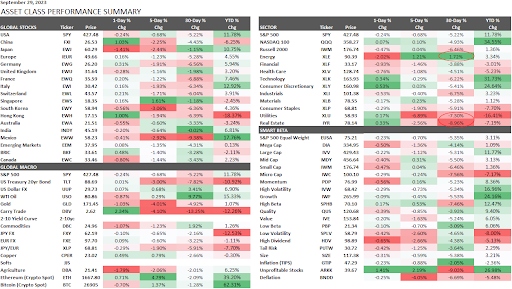

Traders decided there were too many negative factors in September – the UAW strike, US Government shutdown, high crude oil prices, and higher interest rates for longer. Stocks finished lower for the month, with S&P 500 down -5.22% and Nasdaq-100 down -4.93%.

The only winning sector in September was Energy stocks, +1.72%. The worst sectors were Real Estate -8.9%, Utilities -7.3%, Industrials -6.75%, and Technology -6.22%.

Looking forward, we are in a period of dormant stock buybacks. Approximately 84% of the S&P 500 are in their blackout period, with roughly 90% anticipated to be in blackout by the week’s end. Goldman Sachs projects the blackout period to conclude around 10/20/23.

The sell-off continues in U.S.10 and 30-year treasury bonds. The 10-year yield reached our profit target, but we still prefer a core short with reduced size. The trend is stretched, and a 20-30 basis point correction is possible.

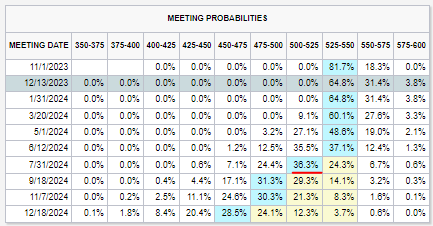

Many traders are now trading the cutting cycle (2024) instead of the hiking cycle. We are near the end of hikes, at least for now.

The Fed Fund Futures markets are pricing the fewest cuts by the end of 2024. The market is pricing in the July 31 Fed meeting with the highest chance of an interest rate cut.

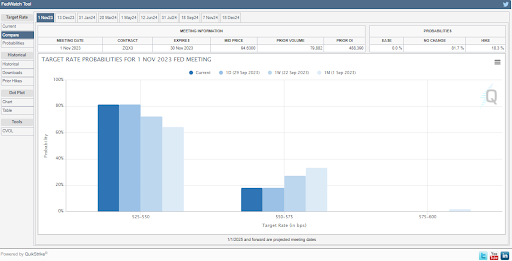

The November 1 FOMC meeting now has an 81.7% probability of no rate change.

Traders look to this week’s Organization of the Petroleum Exporting Countries and allies for further clues on tight global energy supplies.

Oil futures prices have been trending higher, with oil prices up 6.8% on the month. This was driven by a combination of factors, including lower-than-expected oil inventories.

Russia and Saudi Arabia have been working together to support the oil market between $80 and $100 per barrel.

However, it is unclear whether they will be able to maintain this support if oil prices go above $100 per barrel. This is because the U.S. presidential election is approaching, and both countries may be reluctant to see oil prices rise too high.

If oil prices rise above $100 per barrel, it could lead to several negative consequences, including higher inflation, higher interest rates, and financial turmoil. However, the downside risk to oil prices may be limited.

This is because there are a number of factors that could support oil prices at lower levels, such as OPEC+ cuts, higher coal production costs in China, and the likely refill of the US Strategic Petroleum Reserve.

This week’s BoJ Summary of Opinions will likely serve as a reminder of the reluctance of the BoJ to move swiftly on abandoning unconventional policies.

Many forecasts call for higher JGB yields for Q1 2024; 10-year JGB at 1.25% and peak USD/JPY at 155.

The floodgate has opened with the approval of Ethereum (ETH) futures ETFs.

This week, the NYSE will list the ProShares Ether Strategy ETF (NYSE Arca: EETH), the ProShares Bitcoin & Ether Market Cap Weight Strategy ETF (NYSE Arca: BETH), and the ProShares Bitcoin & Ether Equal Weight Strategy ETF (NYSE Arca: BETE) on Monday.

The Arca platform will also begin trading the Bitwise Ethereum Strategy ETF (NYSE Arca: AETH) and the Bitwise Bitcoin and Ether Equal Weight Strategy ETF (NYSE Arca: BTOP).

On the spot market ETF side, the SEC delayed decisions on the Global X, Valkyrie, BlackRock, Invesco, and ARK 21Share spot Bitcoin ETF applications.

This marks the third extension for Ark 21 Shares, the second for Valkyrie, and the first for Global X. Decisions are due on January 10, January 15, and November 21, respectively.

Seven other Bitcoin ETF applications, including the Invesco Galaxy Bitcoin ETF, await decisions between mid-October and late-November.

Reports of optimism from Beijing about a possible year-end summit between Xi Jinping and Joe Biden, coupled with discussions about a possible trip to Washington by Vice Premier He Lifeng, suggest that the two sides may be moving closer to a meeting.

Given the strained state of US-China relations, a summit between Xi and Biden would be a significant development. The two leaders have not met in person since November 2021, and relations have deteriorated over issues such as trade, Taiwan, and human rights.

A summit could allow the two sides to discuss their differences and explore ways to manage their rivalry more effectively. It could also help to reduce tensions and avoid a more serious conflict.

It is important to note that there are still significant obstacles to a summit. Both sides have their own red lines, and it is unclear whether they will be able to find common ground on key issues. However, the fact that both sides are reportedly discussing a meeting is a positive sign.

This performance chart tracks the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.