Home › Market News › Fragility Risk, British Inflation, and Last Week’s Crypto Spike

The Economic Calendar:

MONDAY: Dallas Fed Manufacturing Survey, 3-Month Bill Auction, 6-Month Bill Auction, 2-Yr Note Auction

TUESDAY: Durable Goods Orders, Case-Shiller Home Price Index, FHFA House Price Index, Consumer Confidence, New Home Sales, Richmond Fed Manufacturing Index, 5-Yr Note Auction, Money Supply

WEDNESDAY: MBA Mortgage Applications, International Trade in Goods, Retail Inventories, Wholesale Inventories, Jerome Powell Speaks, State Street Investor Confidence Index, EIA Petroleum Status Report, Survey of Business Uncertainty, 4-Month Bill Auction, 2-Yr FRN Note Auction, 7-Yr Note Auction

THURSDAY: GDP, Jobless Claims, Corporate Profits, Pending Home Sales Index, EIA Natural Gas Report, 4-Week Bill Auction, 8-Week Bill Auction, Fed Balance Sheet

FRIDAY: Personal Income and Outlays, Chicago PMI, Consumer Sentiment, Baker Hughes Rig Count, Farm Prices

Futures Expiration and Rolls This Week:

There are no expirations or rolls this week.

Key Events:

The S&P 500 closed lower last week by -1.42%, and the Nasdaq 100 was down -1.46%. This week traders eye the inflation report and Chair Powell’s speech comments as the primary catalysts.

The inflation and Fed narrative has started again. Inflation levels remain elevated, and Federal Reserve policy remains tighter.

1. What if we see CTAs turn sellers in the summer months in a volume environment already showing signs of falling further into the summer months?

2. What if a turn triggers higher volatility and a de-grossing from some money managers who have just been ‘stopped in’?

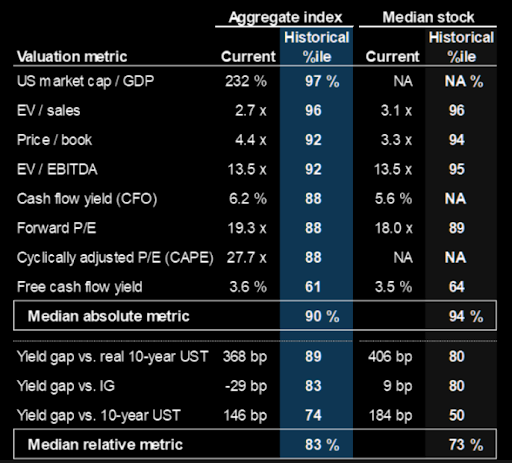

3. Stock valuations are stretched to extremes in many metrics.

This week’s PCE inflation data will be scrutinized. How much tightening is required to help bring inflation back down to the Fed’s 2% target?

Given the FOMC’s highly data-dependent stance, it will only be one part of the matrix. The next FOMC meeting is July 26th, and we will see another job and CPI report to help guide expectations.

Currently, markets are pricing in a 75% probability of a 25 basis point hike in July and a 25% chance of an unchanged outcome. The Fed’s recent dot plots have guided us to two more rate hikes, taking rates to between 5.50- 5.75%; however, markets are pricing in a peak rate between 5.25-5.5%.

The BofA derivatives team outlines a few bullets that we thought were interesting:

U.S. Treasury yields compared to last week:

30-Year yield 3.81%

10-Year yield 3.73%

5-Year yield 3.99%

2-Year yield 4.74%

2-10 Yield spread -1.01%

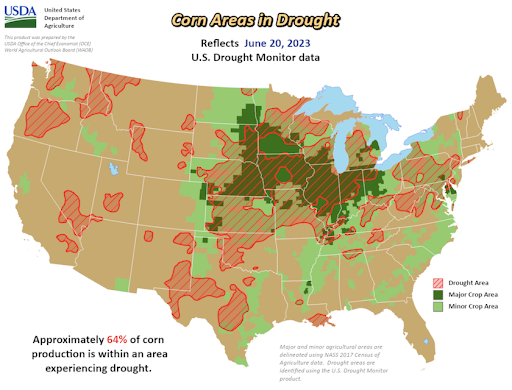

It rained over the weekend in the Midwest, but it’s only temporary, according to the latest forecast.

Corn, soybean, and wheat prices have been soaring this month as growing conditions across the Midwest, a top-producing crop region, have rapidly deteriorated due to the lack of rainfall.

Drought continues to be an important story for farmers and grain traders this year. New data shows drought conditions are deepening across the Midwest. According to the National Drought Mitigation Center, 64% of the corn and 57% of the soybean crops across the U.S. are in drought.

This week also saw notable drops in crop conditions. The USDA says 55% of the corn crop is rated good to excellent. There are only two years in history where condition ratings have been lower this week: 1992 when 52% of the crop was rated good to excellent, and 1988 with a 37% good to excellent rating.

Bitcoin soared +17.1% last week to close over the psychological $30,000 level. Many attribute the rally to Wall Street firm’s new interest in the crypto sector.

Some of the biggest names in finance are making new bets on cryptocurrencies, adding competition and momentum to an industry under increasing pressure from U.S. regulators. BlackRock wants to start a new exchange-traded fund using Bitcoin as an underlying asset. Citadel Securities is backing a new cryptocurrency exchange, along with Fidelity Investments and Charles Schwab.

Some traders are not chasing, but during uptrends, you’ll likely see prices continuing to run rather than having deep corrections. If we have a correction, $28,500 is a good buy level.

Headline PCE is expected to show signs of cooling once again. Markets look for a 0.1% rise, down from the prior 0.4%, while the Y/Y, which previously was 4.4%, is forecast at 4.1%.

PCE is the Fed’s preferred gauge of inflation and will be viewed in helping determine the Fed’s next move.

Recent inflation reports, including the May CPI and PPI, were cooler than expected, and we will be looking to see if that trend follows suit in the PCE report. The latest Fed meeting saw them initiate a “skip,” with Powell noting the July meeting will be held live.

The Bank of England hiked interest rates by a larger 50 basis points, marking the 13th consecutive rate rise as the battle to tame inflation continues.

The Bank added that if there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.

In reaction, the GBP initially spiked higher, then fell shortly after as the market wrestled with the idea of more rate hikes to come that would increase the fear of a recession.

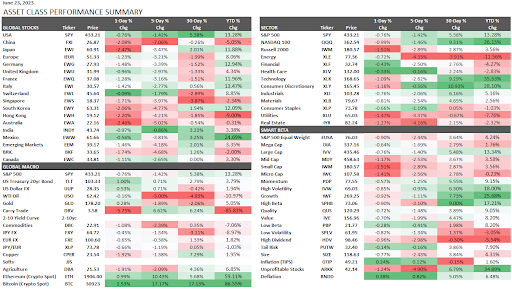

This performance chart tracks the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.

You will not win on all trades. Consistently profitable traders use mental discipline and follow system and risk rules. The confidence to follow these rules comes from testing the system rules repeatedly on hundreds of trades.