Home › Market News › Fed Quells Inflation Fears

Confidence in Fed Chairman Jerome Powell’s testimony on monetary policy did a lot to quell some inflation fears and sent stocks soaring early Wednesday. The Dow Jones rocketed to close at new all-time highs coming off a few days of reasonably flat trading. It appears that all news is good news right now.

The Phil Flynn Energy Report

“Oil prices are waking up to the reality that underinvestment and Biden’s fixation on climate change leadership will leave the globe undersupplied with oil and gas. The market’s starting to price in a possible energy crisis and the future impact that it’ll have on people’s lives and economic growth.”

IraEpstein.com

“Each day Ira Epstein gets you up to speed on what happened in the metals futures markets. Ira focuses on relevant economic and geopolitical topics that affect the precious and base metals markets. Learn about the technicals and fundamentals of gold, silver, copper, platinum, and all metals futures markets.”

Limit Up! Podcast

“GameStop’s soaring stock price and the David versus Goliath narrative of retail traders up against massive hedge funds dominated the trading news this past week. So, what actually happened? On this special edition of Limit Up!, Jack, Dan, and John Doherty discuss how posts on the WallStreetBets Reddit page blew up the market and how Robinhood failed its first stress test. Tune in for all the details.”

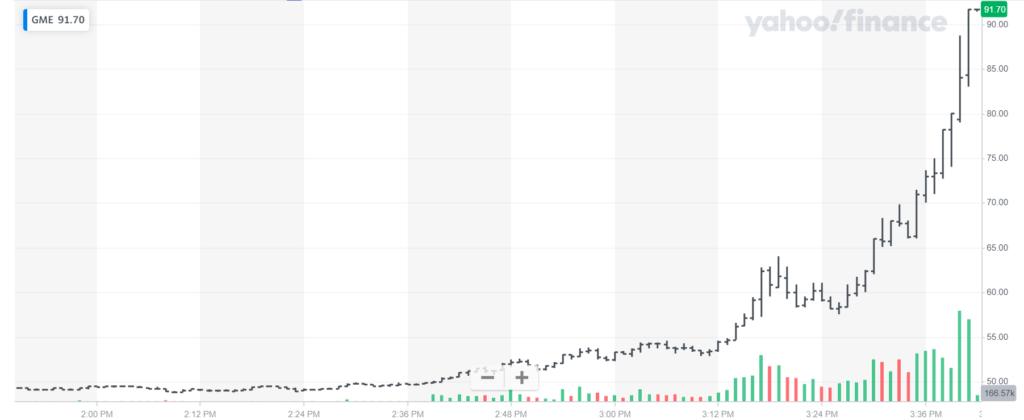

GameStop Takes Another Shot At The Moon!

GME chart courtesy of Yahoo Finance.

It looked like GameStop had found a value area in the $45-$55 range since its spike up to $483 back in late January. As it turned out, the Wallstreetbets Reddit fellowship wasn’t quite finished YOLO’ing, and a late-day push sent the retail gaming stock ripping higher to close up more than 100% on Wednesday.

The likelihood of another short squeeze setting up is low. The move did come on the heels of the announcement of GameStop CFO Jim Bell’s resignation Tuesday, so there are some fundamental factors to consider here. Whatever the reasons turn out to be, anyone who held on for another shot at the moon has to be feeling pretty good right now.

Buying continued in after-hours trading as European stock traders got in on the action, and GME is on track to open sharply higher on Thursday.

For more trading news and information ahead of the opening bell, subscribe to the Daily Market Forecast with John Hoagland and Dan Hodman each morning at 8:00 AM CT.

Trade Well!