Home › Market News › Equities Rise, Yields Dive, Lots of Fed Speak This Week

Not much in the way of economic releases this week, but oh boy, do we have plenty of Fed speeches on tap…

The Economic Calendar:

MONDAY: 10:00 Fed Cook Speech, 15:00 Crop Progress

TUESDAY: 7:30 US Balance of Trade, 8:15 Fed Barr Speech, 8:50 Fed Jeffrey Speech, 9:00 Fed Waller Speech, 11:00 Fed Williams Speech, 12:30 Fed Logan Speech, 15:30 API Crude Oil Stock Change

WEDNESDAY: 8:15 Fed Chair Powell Speech, 9:30 Crude Oil Inventories, 12:40 Fed Williams Speech, 13:00 Fed Barr Speech, 15:45 Fed Jefferson Speech

THURSDAY: 7:30 US Jobless Claims, 8:30 Fed Bostic Speech, 9:30 Natural Gas Inventories, 10:00 Fed Barkin Speech, 11:00 Crop Production, 13:00 Fed Chair Powell Speech

FRIDAY: 9:00 Michigan Consumer Sentiment

Key Events:

The Fed kept rates unchanged at 5.25%-5.50%, which aligned with traders expectations.

The key takeaways:

The S&P 500 futures jumped 5.85%, and the Nasdaq 100 surged 6.49%, as hopes that the Federal Reserve’s interest rate hikes might have ended.

Most traders are thinking this rally could be a short squeeze, than a new phase of a bull market. We will see how long the rally lasts.

The sectors and smart beta indexes that outperformed last week were – Unprofitable Stocks +18.59%, Real Estate +8.71%, Financials +7.41%, and Consumer Discretionary +7.11%

November Seasonals: Below is a grid of the median SPX daily performance since 1928. As you can see, November typically starts the month strong.

Source: Goldman Sachs

Dovish communication and softer payrolls speak against a December Fed hike, but it may only postpone the final hike to 2024.

Jerome Powell’s language was cryptic but enough for traders to view his comments as a dovish pivot. After leaving rates unchanged at 5.25%-5.50%, Powell said, “Slowing down is giving us, I think, a better sense of how much more we need to do, or if we need to do more.”

Traders are focusing on the upcoming easing cycle, where we went from pricing in over 200 basis points of cuts on the curve in July to just 106bps earlier this month. The SR3Z3-Z6 spread is a close proxy to the number of hikes on the yield curve and is currently 131.5bps.

With the Fed decision out of the way, here are a couple of catalysts we are watching:

1) Gargantuan U.S. bond supply – despite the modest miss in refunding expectations, they still total ($112BN vs $114BN) a massive amount. The Treasury Department announced last Wednesday to accelerate the size of its auctions as it looks to handle its heavy debt load.

2) Bank of Japan (BoJ) – the BOJ is finally starting to tighten, which is why it is highly significant what steps the BoJ takes to handle its heavy debt load.

The FOMC meeting was “dovish” to traders but made it clear that the Fed does not feel the need to hike just because data is robust.

That is less supportive for the U.S. Dollar and helps explain the market reaction following the decision. The employment report on Friday only added to this narrative, with another solid headline gain but no evidence of tightness in the unemployment rate or wage trend.

The Bank of Japan left interest rates on hold but said it would take a more flexible approach to controlling yields on 10-year government debt (JGBs), saying the 1% level was now a reference point.

This subtle shift in language resulted in significant weakness in the Japanese Yen.

U.S. Treasuries are starting to lose their appeal as a safe haven asset. If this trend continues, it will force investors to recalibrate how they think about risk, safe havens, and capital allocation.

Since the Russia/Ukraine conflict started, bitcoin has appreciated around 50%. Since the Hamas/Israel conflict started, bitcoin is up about 24%. Not only is bitcoin up materially on both time frames but remember that bitcoin has appreciated at the same time that U.S. Treasury Bonds has gone down.

This development is surprising enough that a few esteemed money managers are discussing it.

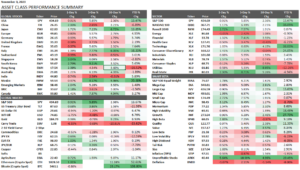

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.