Home › Market News › Early Close For Futures Markets

The Economic Calendar:

MONDAY: Presidents Day Holiday – Markets Closed

TUESDAY: PMI Composite Flash, Existing Home Sales, 3-Month Bill Auction, 6-Month Bill Auction, 52-Week Bill Auction, 2-Yr Note Auction

WEDNESDAY: MBA Mortgage Applications, State Street Investor Confidence Index, 4-Month Bill Auction, 2-Yr FRN Note Auction, 5-Yr Note Auction, FOMC Minutes, John Williams Speaks

THURSDAY: GDP, Jobless Claims, Chicago Fed National Activity Index, EIA Natural Gas Report, Raphael Bostic Speaks, EIA Petroleum Status Report, Kansas City Fed Manufacturing Index, 4-Week Bill Auction, 8-Week Bill Auction, 7-Yr Note Auction, Fed Balance Sheet

FRIDAY: Personal Income and Outlays, New Home Sales, Consumer Sentiment, Loretta Mester Speaks, Baker Hughes Rig Count

Futures Expiration and Rolls This Week:

TUESDAY: Last trading day for March (H) Crude Oil futures

WEDNESDAY: Natural Gas futures roll from March (H) to April (J)

THURSDAY: Interest Rate futures roll from March (H) to June (M); Roll day for Grain futures

Key Events:

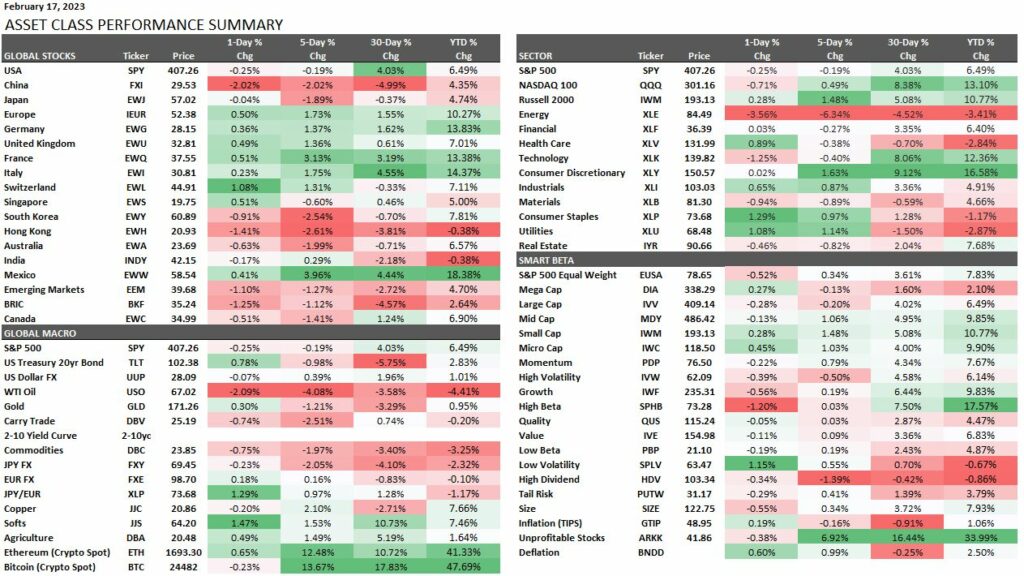

The market was mixed last week, with the S&P lower by -0.19% and the Nasdaq 100 higher by 0.49%.

The markets are abuzz as anxious traders nervously eye any mention of “inflation” as if it were a monster in the shadows. This week, we look for a reading from the Fed’s favorite inflation PCE indicator.

Last Thursday, stocks took a tumble after January’s producer price index revealed prices were higher than expected.

A few key short-term levels for the S&P 500:

Upside: 4135,4170,4208, 4220

Downside: 4055, 4005, 3970, 3915

St. Louis Fed President James Bullard spoils the recovery thesis after saying he wouldn’t rule out supporting a 50-basis point rate hike at the March FOMC meeting,

A few things to digest here: (1) Mr. Bullard has been among the most prominent hawks at the Fed (2) Cleveland Fed President Mester said earlier today that she, too, was advocating for a 50-basis point rate hike at the last meeting.

Neither Bullard nor Mester are voters on the 2023 FOMC. Nonetheless, their hawkish-minded clarifications play into the market’s growing concern that the Fed isn’t inclined to hit the pause button yet or cut rates this year.

Presumably, even if these Fed officials don’t have a vote on the FOMC this year, they will be making their views known at the FOMC meetings. They are also being looked at as potential signal callers for the Fed, which wants to start floating some trial balloons with remarks that rein in some of the complacent behavior seen in stocks and cryptocurrencies.

U.S. Treasury yields current yield compared to the last newsletter:

30-Year yield 3.87% vs. 3.82%

10-Year yield 3.82% vs. 3.74%

5-Year yield 4.03% vs. 3.92%

2-Year yield 4.62% vs. 4.51%

2-10 Yield spread -0.80% vs. -0.77%

Commodities are flying around as two non-voting Federal Reserve officials are jawboning a 50-basis-point interest rate hike.

A rise in the producer price index and the hot jobs data prompted the Federal Reserve to warn of further rate hikes, which lifted the U.S. dollar. The stronger dollar and fears of more aggressive rate hikes knocked the legs from under gold, silver, and other dollar-sensitive commodities.

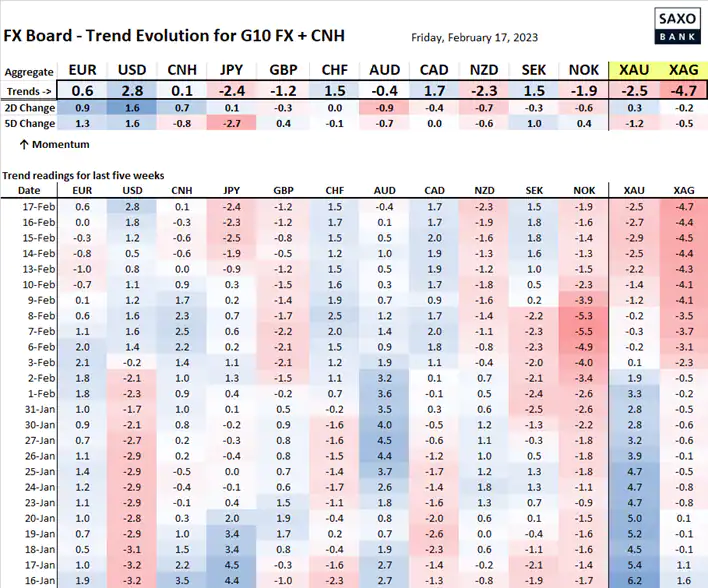

The U.S. dollar index is on a roll as traders are betting that the Federal Reserve will raise interest rates sooner than expected and keep them there longer than usual. This means the dollar index has hit a six-week high against a basket of currencies.

Cleveland Fed President Loretta Mester and St. Louis President James Bullard were both singing a hawkish tune, commenting that the economy—and the consumer—were too strong for their good. Loretta Mester was vehement in her stance, declaring a “compelling economic case” to raise the rate aggressively.

Even European Central Bank Executive Board member Isabel Schnabel weighed in, raising fears of increasing global interest rates. Still, these warnings weren’t enough to spark a huge surge in the U.S. dollar.

Bitcoin isn’t phased by the recent regulatory attack on the cryptocurrency market. Even after all the negative news, it still found a way to rally, showing that it’s resilient and bullish!

Bitcoin futures traded above $25,000, which is a six-month high. BTC has been trading between $15,500 to $25,200 since June 2022.

Some analysts were saying that last week’s U.S. inflation day would be a critical event that could lead to Bitcoin prices skyrocketing, and it looks like they were right! The same analysts predict that Bitcoin prices will be back at $45,000 by the end of the year – so keep your eyes peeled!

This performance chart tracks the daily, weekly, monthly, and yearly changes of a variety of asset classes, including some of the most popular and liquid markets available to traders.

Prepare for markets, do your homework, take care of your body, and be aware of the mental game of trading.