Home › Market News › Crypto Trends, Copycat Trades, and Oil Drivers

The Economic Calendar:

MONDAY: Michael Barr Speaks, Wholesale Inventories, Mary Daly Speaks, 3-Month Bill Auction, 6-Month Bill Auction, Investor Movement Index, Consumer Credit

TUESDAY: NFIB Small Business Optimism Index, 52-Week Bill Auction, 3-Yr Note Auction

WEDNESDAY: MBA Mortgage Applications, CPI, Atlanta Fed Business Inflation Expectations, EIA Petroleum Status Report, 4-Month Bill Auction, 10-Yr Note Auction, Beige Book

THURSDAY: Jobless Claims, PPI, EIA Natural Gas Report, 4-Week Bill Auction, 8-Week Bill Auction, 30-Yr Bond Auction, Treasury Statement, Fed Balance Sheet

FRIDAY: Import and Export Prices, Consumer Sentiment, Baker Hughes Rig Count

Key Events:

Traders failed to keep the bull higher, as a late-week selloff on the S&P 500 erased an early-week rally to leave the index -1.07% lower for the holiday-shortened week. June payrolls came in lighter than expected for the first time since April last year, and the VIX slipped back below 15.

The U.S. Treasury curve flattened a bit, with two-year yields higher five basis points to 4.95% and the long bond rising eighteen basis points to 4.05%.

WTI crude reached a six-week high near $73.60 a barrel, and gold rebounded to $1931 per ounce.

It’s officially Q2 earnings season. 82% of S&P 500 firms will report by August 7th. Will companies be able to meet the low bar set by consensus?

Q2 2023 earnings season will begin this week, and consensus expects a 9% year-over-year decline in S&P 500 EPS driven by flat sales growth and margin compression.

S&P 500 corporations have issued 62 negative EPS pre-announcements compared to 39 positive, which the London Stock Exchange computes is an N/P ratio of 1.6 for the S&P 500 Index. This compares to a long-term average of 2.5 and a prior four-quarter average of 2.0.

While the oil market is finally starting to show signs of tightening, the OPEC+ production cuts and replenishing of the Strategic Petroleum Reserve have failed to tighten balances significantly. However, crude oil futures prices are starting to lift and were +5.8% last week.

There have been two drivers recently:

How many rate hikes are ahead?

The June FOMC minutes reaffirmed our expectation that a 25 basis point rate hike in July is very likely. Even at the June FOMC meeting, where the Fed paused rate hikes, “some” FOMC participants would have preferred to hike.

A CPI surprise this week could reset expectations on the direction of the Federal Reserve. Traders were pricing in a 93% probability that the Federal Reserve would raise rates by 25 basis points at the July 25-26 meeting.

One hawkish viewpoint taking shape by the FOMC is the possibility that monetary

policy lags are overstated, and the peak impact of tightening may have already been realized. This suggests additional hikes until an inflation print of close to 2%, a more hawkish approach than the FOMC consensus to slow (and eventually pause) rate hikes this year.

U.S. Treasury yields compared to last week:

30-Year yield 4.04% vs. 3.86%

10-Year yield 4.07% vs. 3.84%

5-Year yield 4.36% vs. 4.15%

2-Year yield 4.95% vs. 4.90%

2-10 Yield spread -0.88% vs. -1.05%

Source: CME FedWatch Tool

Multiple rainstorm systems traveled across the corn belt heart over the weekend. Traders will watch how the market reacts after reducing the drought risk premium.

Bitcoin has been provided with the tailwind of two events this year with the SVB banking crisis and Blackrock Bitcoin ETF filing that have unequally benefited Bitcoin relative to the other digital assets in the market. This has translated to Bitcoin’s market capitalization dominance relative to the rest of the market, breaching 50% for the first time since early 2021.

Trends:

Should we, as traders, look at the copycat strategy? Billionaire Mark Zuckerberg isn’t particularly shy about copying a good idea when he sees one.

From cribbing Snapchat’s stories feature to cloning TikTok in the form of Instagram Reels, the Facebook co-founder has a long and well-documented history of being a copycat. Now he’s copying the playbook from Twitter and launching a social media clone called Threads.

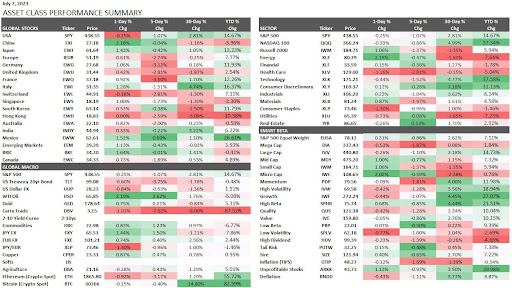

This performance chart tracks the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.

Should we, as traders, look at the copycat strategy? Billionaire Mark Zuckerberg isn’t particularly shy about copying a good idea when he sees one.

From cribbing Snapchat’s stories feature to cloning TikTok in the form of Instagram Reels, the Facebook co-founder has a long and well-documented history of being a copycat. Now he’s copying the playbook from Twitter and launching a social media clone called Threads.