Top things to watch this week

The Economic Calendar:

MONDAY: Building Permits (7:00a CST), Raphael Bostic Speaks (7:25a CST), New Home Sales (9:00a CST), Dallas Fed Manufacturing Index (9:30a CST), Lisa Cook Speaks (9:30a CST), 2-Year Note Auction (12:00p CST)

TUESDAY: Durable Goods (7:30a CST), Redbook (7:55a CST), Housing Price Index (8:00a CST), Case Shiller Home Price Index (8:00a CST), Consumer Confidence (9:00a CST), Richmond Fed Manufacturing Index (9:00a CST), 5-Year Note Auction (12:00p CST)

WEDNESDAY: MBA Morgage Applications (6:00a CST), EIA Petroleum Stats Report (9:30a CST), 7-Year Note Auction (12:00p CST), Christopher Waller Speaks (5:00p CST)

THURSDAY: Jobless Claims (7:30a CST), Real Consumer Spending (7:30a CST), Chicago PMI (8:45a CST), University of Michigan Consumer Sentiment (9:00a CST), Pending Home Sales (9:00a CST), EIA Natural Gas Report (9:30a CST), Kansas Fed Manufacturing Index (10:00a CST), Planting Expectations & Quarterly Grain Stocks (11:00a CST), Baker Hughes Rig Coung (12:00p CST)

FRIDAY: Good Friday Holiday – CME Markets are Closed, Core PCE (7:30a CST), Retail Inventories (7:30a CST), Wholesale Inventories (7:30a CST), Fed Chair Powell Speech (9:00a CST)

Key Events:

- FOMC will scrutinize data for the next Fed rate decision.

- Busy economic report week with personal income & spending, Q423 GDP. Also on deck are durable goods orders, new home sales, and consumer confidence, among others.

- Agriculture futures traders get prospective planting forecasts for this growing season.

- Corn and soybean traders will be watching the weather over the next few days for more precipitation.

- Fed speak from Bostic, Cook, Waller, and Chairman Powell.

STOCK INDEX FUTURES

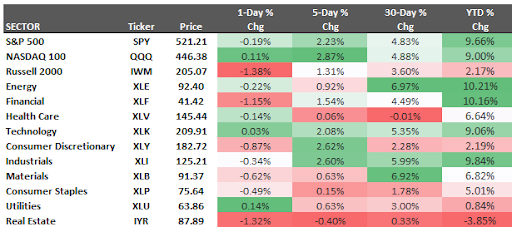

Stock markets welcomed the more dovish messaging coming out of the Fed and Chair Jerome Powell, and we saw stock markets reach new highs. The S&P 500 traded higher +2.2%, and the Nasdaq 100 was up by +2.8%.

Société Générale is now the most bullish investment bank out there, lifting their S&P 500 year-end forecast to 5,500 (Prev. 4,750).

Some equity analysts say there’s no stopping the record-breaking rally in U.S. stocks against an improving outlook for corporate earnings and the frenzy around artificial intelligence.

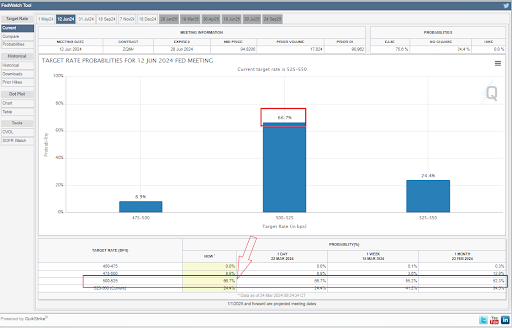

INTEREST RATE FUTURES

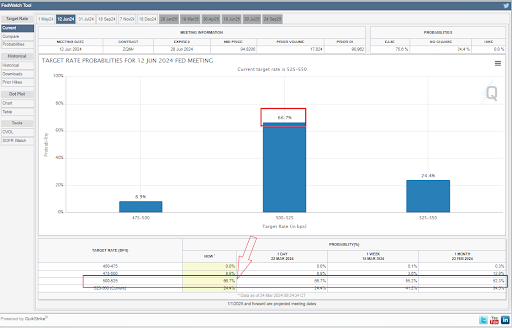

It was a busy week in interest rate futures trading last week with the FOMC rate decision. The bottom line is the market is starting to price a 25 basis point rate cut in June.

Key takeaways from the Federal Reserve meeting and recent central bank actions:

- The Fed maintains its plan for 3 rate cuts in 2024. Despite slightly higher inflation forecasts, the Fed continues to expect inflation to fall and supports a rate cut plan.

- The market is pricing in a potential 25 basis point rate cut as early as June.

- Stock market reacts positively: Unlike past decisions, the Fed’s message led to a surge in stock prices.

- Swiss National Bank cuts rates: Adding to the easing sentiment, the Swiss National Bank unexpectedly cut rates, further fueling speculation of broader central bank easing.

- Fed “dots” show long-term rate increase: While dovish on short-term rates, the Fed sees long-term rates eventually rising to a new equilibrium point of 2.6%.

- Fed Chair Powell downplays inflation concerns: Powell believes inflation will fall despite recent bumps and current interest rates are already restrictive enough.

- Bond market anticipates rate cuts: Bond traders see the Fed’s message as a sign of future rate cuts, even with stronger inflation or growth.

Source: CME Fedwatch

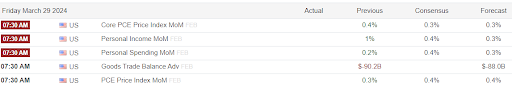

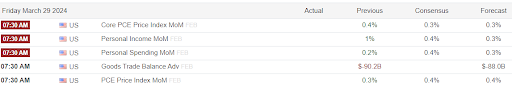

NEXT KEY DATA REPORT FOR FOMC (PCE Inflation)

The next key data point for the Fed is the February PCE inflation report on Friday, which should continue to show relatively firm price inflation pressures for February, albeit to a lesser degree than in January.

Specifically, we expect headline PCE to rise 0.4% MoM, with the YoY pace unchanged at 2.4%, while we look for core PCE to rise 0.3% MoM, with the YoY pace holding steady at 2.8%.

CORN, SOYBEAN, & WHEAT FUTURES

This Thursday, we’ll see big flows and volume around the Stocks & Planting Intentions reports.

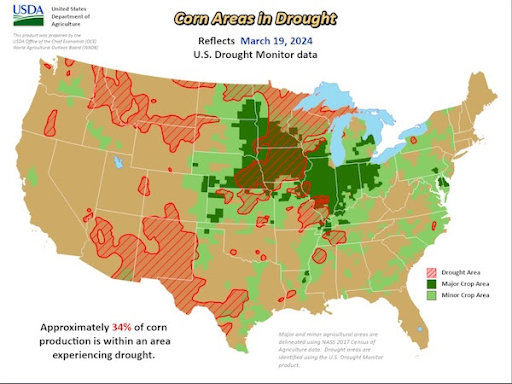

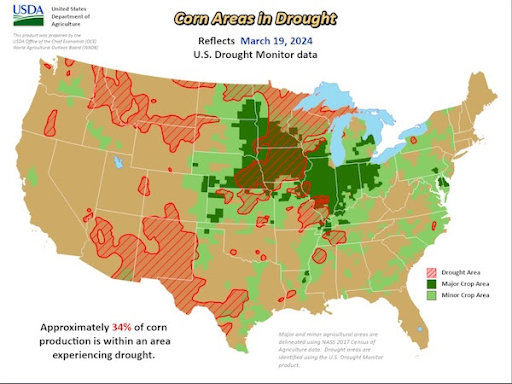

The grain trade also has some weather to watch. There have been a lot of grain futures bulls talking about dry conditions in parts of Iowa, Minnesota, Missouri, Nebraska, and Wisconsin.

The weather forecast below shows a large amount of moisture is forecast to fall over some of the driest parts of the corn belt during the next several days.

The fear for traders is that even though these rains are welcomed and needed, they may only provide temporary relief as the longer-term forecasts show the drought in these parts lingering through the growing season.

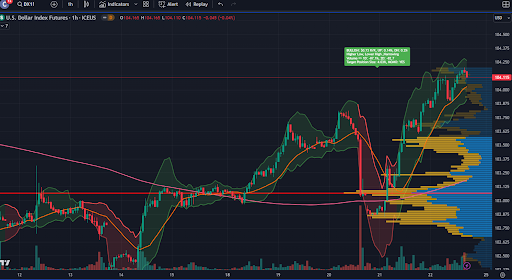

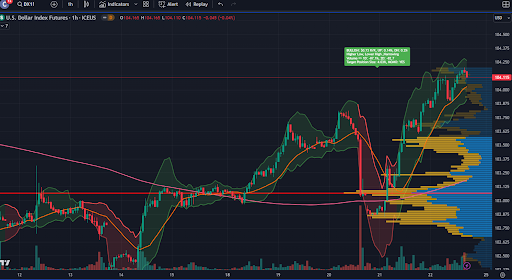

U.S. DOLLAR INDEX FUTURES

The U.S. dollar jumped higher for the second week.

Traders are challenging the Fed’s dovish stance, casting doubts over its forecasts of three rate cuts for this year. The U.S. Dollar Index is firmly above 104.00 and breaks substantial resistance levels.

Source Chart: TradingView

BOE CENTRAL BANK

The Bank of England surprised no one by holding interest rates steady at 5.25%.

However, the real news came from the voting breakdown. Previously hawkish members Haskell and Mann rejoined the majority, suggesting a shift towards a more dovish stance. This news sent the pound lower and U.K. bonds higher as investors ramped up bets on future rate cuts.

The market is now heavily expecting a rate cut in June, with the odds jumping from 50% to 75%.

CRYPTO TRADING

Big red flags for Ethereum (ETH) as the SEC investigates potential security classification. We provide the key items to watch below.

Details:

- The SEC appears to be launching a legal battle to classify Ethereum (ETH) as a security.

- CoinDesk initially reported that a likely U.S. authority investigated the Ethereum Foundation, a Swiss non-profit.

- A recently discovered GitHub commit suggests the Foundation removed investigation disclosure language due to a confidentiality requirement.

- This secrecy points towards a serious probe, potentially involving a Swiss regulator collaborating with the SEC.

- Fortune magazine later confirmed U.S. firms received subpoenas related to the investigation, suggesting a wider effort to classify ETH as a security.

- The recent switch to Proof-of-Stake (PoS) seems to be the main focus of the SEC’s investigation.

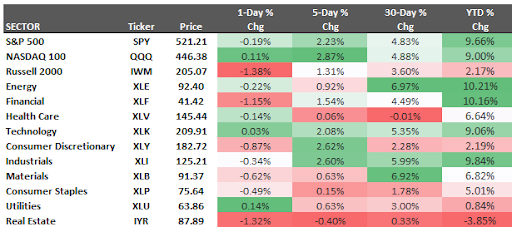

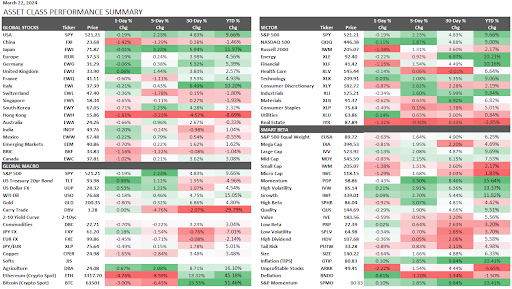

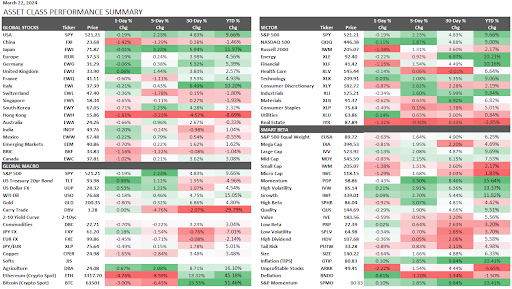

asset class performance sheet

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.

All content published and distributed by Topstep LLC and its affiliates (collectively, the “Company”) should be treated as general information only. None of the information provided by the Company or contained herein is intended as (a) investment advice, (b) an offer or solicitation of an offer to buy or sell, or (c) a recommendation, endorsement, or sponsorship of any security, Company, or fund. Testimonials appearing on the Company’s websites may not be representative of other clients or customers and is not a guarantee of future performance or success. Use of the information contained on the Company’s websites is at your own risk and the Company, and its partners, representatives, agents, employees, and contractors assume no responsibility or liability for any use or misuse of such information.

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the investor’s initial investment. Only risk capital—money that can be lost without jeopardizing one’s financial security or lifestyle—should be used for trading, and only those individuals with sufficient risk capital should consider trading. Nothing contained herein is a solicitation or an offer to buy or sell futures, options, or forex. Past performance is not necessarily indicative of future results.

CFTC Rule 4.41 – Hypothetical or Simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, because the trades have not actually been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.