Home › Market News › Crypto Moves, Grain Prices, and the Crude Oil Rally

The Economic Calendar:

MONDAY: Patrick Harker Speaks (10:00a CST)

TUESDAY: Redbook (7:55a CST), PMI Composite Final (8:45a CST), Factory Orders (9:00a CST), ISM Manufacturing Index (9:00a CST), Vehicle Sales (10:00a CST), Michael Barr Speaks (11:00a CST), Michael Barr Speaks (2:30p CST)

WEDNESDAY: MBA Morgage Applications (6:00a CST), ADP Employment Change (7:30a CST), Fed Chair Powell Testimony (9:00a CST), JOLTS (9:00a CST), Wholesale Inventories (9:00a CST), EIA Petroleum Stats Report (9:30a CST), Mary Daly Speaks (11:00a CST), Beige Book (1:00p CST)

THURSDAY: Challenger Job Cut Report (6:30a CST), Jobless Claims (7:30a CST), Import & Export Prices (7:30a CT), Used Car Prices (8:00a CST), Fed Chair Powell Testimony (9:00a CST), EIA Natural Gas Report (9:30a CST), Loretta Mester Speaks (10:30a CST), Consumer Credit (2:00p CST)

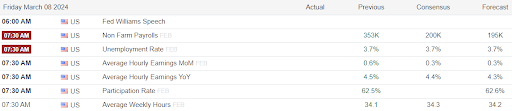

FRIDAY: John Williams Speaks (6:00a CST), Unemployment Rate (7:30a CST), WASDE Report (11:00a CST), Baker Hughes Rig Coung (12:00p CST)

Key Events:

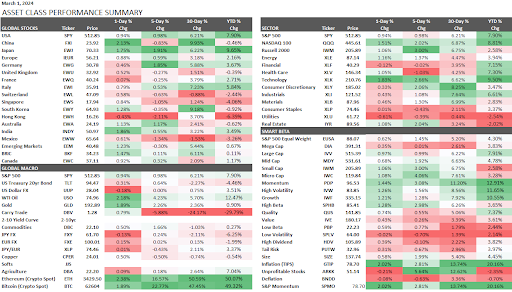

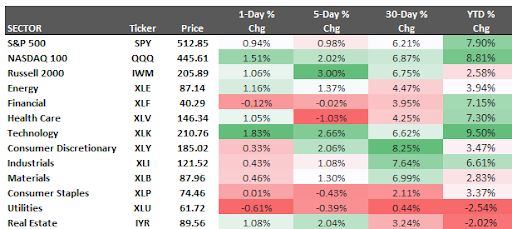

Both the S&P 500 and Nasdaq 100 ended the month of February on a positive note, closing at record highs.

During the week, the S&P 500 closed higher by +0.98%, and the Nasdaq 100 performed even better, closing up +2.02%.

This increase was primarily fueled by solid earnings reports from companies like NetApp and Dell Technologies and positive sentiment surrounding artificial intelligence (AI) stocks.

For February, stock sectors were all positive. The leaders were Consumer Discretionary, Industrials, Materials, and Technology. The laggards were Utilities and Consumer Staples.

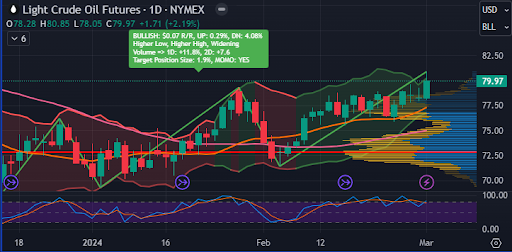

Oil prices hit a three-and-a-half-month high and rallied near $80 last week as market gauges continued to show signs of strength, with OPEC+ expected to extend its current supply cuts into the next quarter.

As usual, Russia plays hard to agree to the trial balloon that would have OPEC+ extend voluntary production cuts until the end of the year. Deputy Prime Minister of Russia Alexander Novak, former Russian energy Czar and former stand-in as Russian president for Putin, said it was premature to talk about the production cut extension.

A tense standoff is unfolding in the grain market. While farmers remain optimistic about a price recovery, hedge funds are betting heavily on continued decline. This tug-of-war will likely play out in the coming months, with the outcome hinging on harvest yields, global demand, and unforeseen events that could disrupt market equilibrium.

The Situation:

Source Image: Bloomberg

Gold futures are hovering near 2-month highs and the key $2,100 level, fueled by hopes of easing inflation and potential interest rate cuts by the Federal Reserve later this year.

The recent rise can be attributed to several factors:

FOMO is alive. For the first time in over two years, Bitcoin’s price surged over $63,000.

Crypto bull markets are unique as they move violently beyond the trader’s imagination.

Overbought conditions tend to last longer than traders expect, and instead of a mean-reversion when prices should correct lower, an overbought Bitcoin signal tends to attract more buyers, and this is when prices rise even more parabolically.

ETFs have more than $9 billion in inflows since they started trading on January 11. There is evidence of many large RIA investment networks that control trillions of dollars in investment capital beginning to list the BTC ETFs on their platforms. This could cause a new flood of buying soon.

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.