Home › Market News › CPI, PPI, and Fed Rate Hike Expectations

The Economic Calendar:

MONDAY: 3-Month Bill Auction, 6-Month Bill Auction

TUESDAY: NFIB Small Business Optimism Index, CPI

WEDNESDAY: MBA Mortgage Applications, Retail Sales, Empire State Manufacturing Index, Industrial Production, Business Inventories, Housing Market Index, Atlanta Fed Business Inflation Expectations, EIA Petroleum Status Report, 4-Month Bill Auction, 20-Yr Bond Auction, Treasury International Capital

THURSDAY: Housing Starts and Permits, Jobless Claims, Philadelphia Fed Manufacturing Index, PPI-Final Demand, Loretta Mester Speaks, EIA Natural Gas Report, 4-Week Bill Auction, 8-Week Bill Auction, 30-Yr TIPS Auction, Fed Balance Sheet, Loretta Mester Speaks

FRIDAY: Import and Export Prices, E-Commerce Retail Sales, Leading Indicators, Quarterly Services Survey, Baker Hughes Rig Count

Futures Expiration and Rolls This Week:

THURSDAY: Crude Oil futures roll from March (H) to April (J)

Key Events:

The S&P drifted lower by -1.05%, and the Nasdaq 100 fell -2.12% on the week. The main driver was traders’ expectations of the Fed’s rate hikes and how long they will remain at peak levels.

Following a parabolic surge in growth stocks to the start of 2023, stocks that had suffered in the previous year have been stalling due to recent higher yields.

Falling yields tend to boost the demand for growth and momentum equities, particularly those in the technology sectors that saw a decrease in value when yields increased in 2022.

A few key short-term levels for the S&P 500:

Upside: 4130,4185,4225

Downside: 4055,4010, 3970

It wasn’t long ago that the market chatter was about the U.S. 2-year yield going below 4%. Now it is over 4.50%.

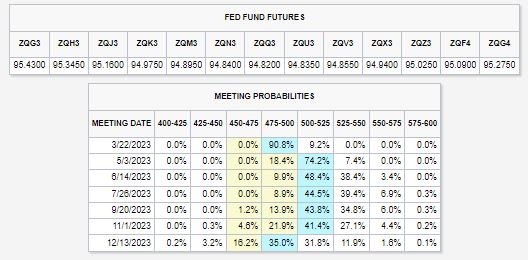

The terminal (peak) rate continues higher at 5.18%, with the probability of hikes growing for May/June/July.

Ex-NY Fed Bill Dudley doesn’t think the “soft landing” scenario is likely, even in the face of better-than-expected economic data and signs of disinflation. He said financial conditions would adjust as the Fed hikes rates further and keeps them there for a while.

Just remember the downside scenario of a soft-landing is there is NO reason for the Fed to cut rates.

U.S. Treasury yields current yield compared to the last newsletter:

30-Year yield 3.82% vs. 3.616%

10-Year yield 3.74% vs. 3.526%

5-Year yield 3.92% vs. 3.66%

2-Year yield 4.51% vs. 4.291%

2-10 Yield spread -0.77 vs. -0.769%

Reports of Russia’s 500,000 barrel-a-day oil production cut sent oil prices higher to around $80. The threat of not selling oil to countries involved in the E.U. price cap has triggered an increase in oil product demand.

Although U.S. data depicting rising inventories has hindered the full effect of the Russian cut, an imminent drop in U.S. inventories are predicted to reveal the longer-term impact of the reduction.

Natural gas is also searching for a price bottom, with the Freeport LNG terminal granting permission to resume some ship loading, potentially creating optimism in demand. However, weather forecasts predicting above-normal temperatures may deter this.

Reports were published last Wednesday morning about an inaccuracy released in a presentation video by Google and their new A.I. chat product called “Bard.”

The markets and the media didn’t discover the Bard error for two days after the video was released.

Still, when they did, the stock price of $GOOGL dropped dramatically and lost over $100 billion in market capitalization. We think this was an overreaction to this news event and noise.

This mistake has been deemed a “black eye” for Google’s A.I. bot, Bard, which was launched to compete with Microsoft’s ChatGPT.

Regulators in the U.S. have clarified that crypto’s popularity does not exempt the industry from existing financial rules and regulations.

Last week, the SEC charged crypto exchange Kraken with failing to register the offer and sale of their crypto asset staking-as-a-service program. Kraken’s staking service involved investors transferring crypto to the venue ‘for staking in exchange for advertised annual investment returns of as much as 21 percent.’

The settlement with the SEC requires Kraken to cease offering staking services to U.S. clients and pay fines totaling $ 30 million.

Coinbase CEO Brian Armstrong also tweeted about rumors that the SEC wants to get rid of crypto staking in the U.S. for retail customers. Is this trouble for COIN stock which drives 11% of Revenue from staking and is the 2nd largest depositor for Ethereum?

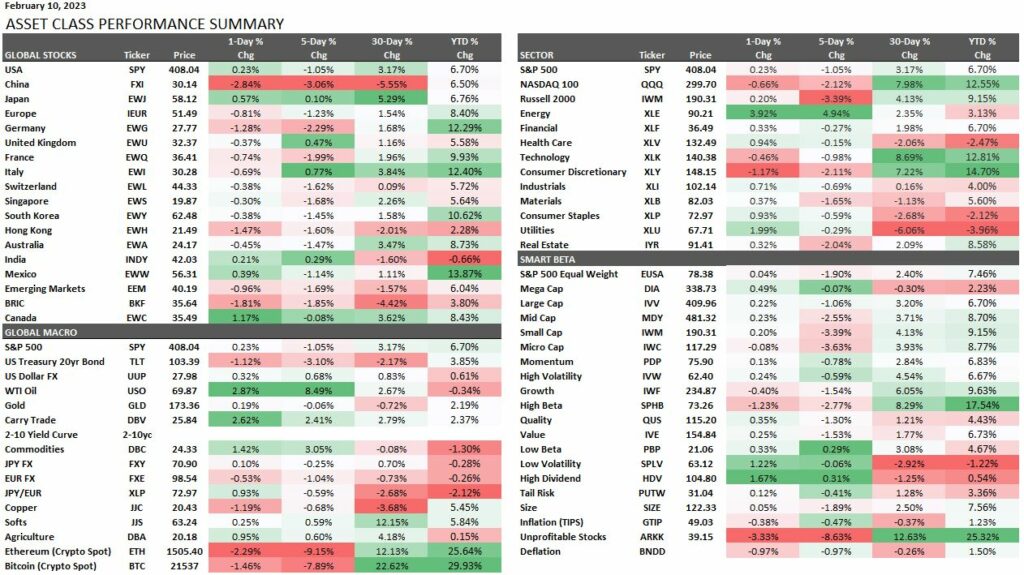

This performance chart tracks the daily, weekly, monthly, and yearly changes of a variety of asset classes, including some of the most popular and liquid markets available to traders.

Traders need to GRIND and keep DARING GREATLY to perform at a high level!