Home › Market News › Copper Futures, Currency Futures, and the Nvidia AI Event

The Economic Calendar:

MONDAY: NAHB Housing Market Index (9:00a CST)

TUESDAY: Building Permits (9:00a CST), Housing Starts (9:00a CST), Redbook (7:55a CST), 20-Year Bond Auction (12:00p CST), 2-Day FOMC Meeting Begins

WEDNESDAY: MBA Morgage Applications (6:00a CST), EIA Petroleum Stats Report (9:30a CST), Fed Rate Decision (1:00p CST), Fed Chair Press Conference (1:30p CST)

THURSDAY: Jobless Claims (7:30a CST), Philly Fed Manufacturing Index (7:30a CST), Composite PMI Flast (8:45a CST), Existing Home Sales (9:00a CST), EIA Natural Gas Report (9:30a CST), Michael Barr Speaks (11:00a CST)

FRIDAY: Michael Bar Speaks (11:00a CST), Baker Hughes Rig Count (12:00p CST), Raphael Bostic Speaks (3:00p CST)

Key Events:

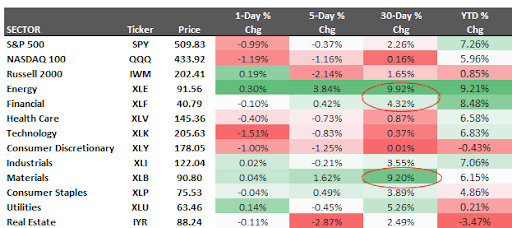

The S&P 500 fell for the second week in a row, with tech and consumer discretionary stocks particularly downbeat. The S&P 500 pulled back by -0.37%, while the tech-heavy Nasdaq fell -1.16%.

Worries about this Wednesday’s FOMC rate decision and recent higher than expected Inflation data have traders looking for downside hedges for protection

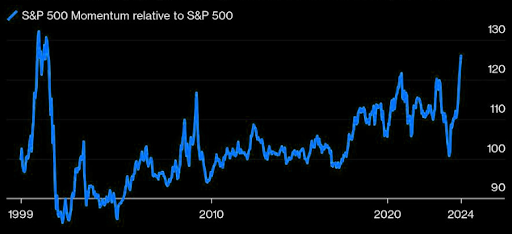

Despite this week’s modest pullback, the S&P 500 is experiencing its most robust momentum-driven rally in 24 years. NVDA, AI, and tech stocks make up most of the MoMo trades.

If this trade starts to unwind, it could get really nasty.

Source: Zerohedge

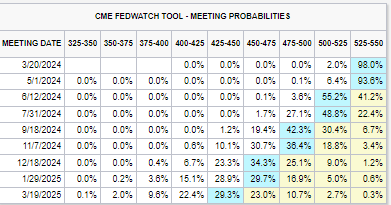

Traders are not expecting the FOMC to adjust policy rates at this week’s meeting; attention will be on the Committee’s updated dot plots.

Traders expect the Fed to lower rates by 75bps or less this year (three 25bps cuts), according to 58 of the 108 economists surveyed by Reuters.

The Fed Fund Futures market implies a 34% probability of a 75 basis point rate cut by December.

Some traders are pondering – what if they skip a cut in June? The Fed Fund Futures market now implies a 55% probability of a 25 basis point cut in June.

Source CME Fedwatch

There is a Nvidia developer conference this week. The recent history of NVDA’s significant events has been a short-term market to fade. Will the Nvidia developer conference rhyme with past major announcements?

Even in-play AI stocks need to take a breather. In our experience, it typically happens around events like these.

Steady lads with the green beer in hand.

Last week, we saw Bitcoin go from $73k down to $65k (-12% high to low). It was just a volatile enough move to get the media writing articles asking if “The Bitcoin Bubble Is Bursting.”

Stay focused on the big picture.

Source: Tradingview

Traders will focus on Tuesday’s BOJ announcement and whether the central bank exits its negative interest rate policy.

Markets are pricing a near 50% chance between the central bank maintaining its rate at the current level of -0.10% or if it hikes this by 10bps to 0%. Many analysts think the move is too close to call.

Other rumors are swirling that the BoJ is said to address Yield Curve Control (YCC) and will likely end its 10-year bond yield target upon pulling short-term rates out of negative levels.

Copper prices are rallying to 11-month highs, as Citibank commodity analysts noted they are recommending long positions as the supply outlook turns tighter.

We are playing it with an option position – a June 2024 $9000/$9500 call spread.

Citi analysts said they also expected an improvement in copper demand, with the global manufacturing cycle showing signs of bottoming out. They also expected a “building equity bubble” to factor into increased consumption, in turn helping copper demand.

A few drivers:

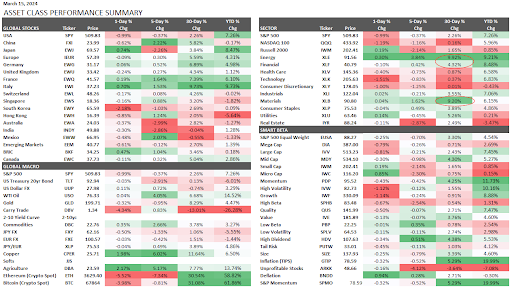

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.