Top things to watch this week

The Economic Calendar:

MONDAY: Consumer Inflation Expectations (10:00a CST), 3-Year Note Auction (12:00p CST)

TUESDAY: NFIB Business Optimism Index (5:00a CST), CPI (7:30a CST), Redbook (7:55a CST), 10-Year Note Auction (12:00p CST), Monthly Budget Statement (1:00p CST)

WEDNESDAY: MBA Morgage Applications (6:00a CST), EIA Petroleum Stats Report (9:30a CST), 30-Year Bond Auction (12:00p CST)

THURSDAY: Jobless Claims (7:30a CST), PPI (7:30a CST), Retail Sales (7:30a CST), Business Inventories (9:00a CST), Retail Inventories (9:00a CST), EIA Natural Gas Report (9:30a CST)

FRIDAY: Import & Export Prices (7:30a CST), Empire State Manufacturing Index (7:30a CST), Industrial Production & Capacity Utilization (8:15a CST), University of Michigan Consumer Sentiment (9:00a CST), Baker Hughes Rig Count (12:00p CST)

Key Events:

- Traders focused on CPI (inflation) numbers on Tuesday.

- Economic reports on CPI, producer price index, retail sales, and UoM consumer sentiment.

- Earnings reports from Oracle, Dollar Tree, Kohl’s, and Dick’s Sporting Goods.

- BTC keeps chugging along with forecasts to top market cap of gold around $300k BTC.

- Was it a blow-off-top in NVDA and chip stocks on Friday?

- Fed speaker communication blackout ahead of next week’s decision.

- Traders look ahead to the FOMC decision on March 20 (next Wed).

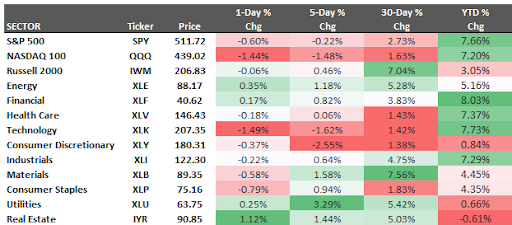

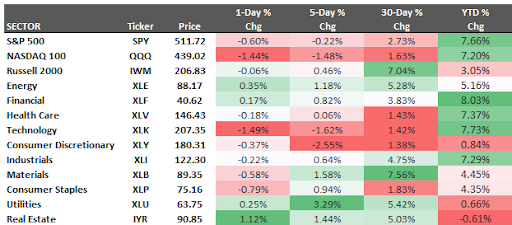

STOCK INDEX FUTURES

The stock markets were mostly flat last week, the S&P 500 pulled back by -0.22%, while the tech-heavy Nasdaq fell -1.48%.

While breadth during this rally has expanded, market direction remains largely at the whim of big tech (chip and AI stocks).

Apple endured a 7-day losing streak before closing higher on Friday, while Nvidia Nvidia shares finished up more than 6% on the week. It’s part of a parabolic rally that added more than $1 trillion to the stock’s market cap in the new year alone.

Somewhat surprising was the February jobs report on Friday that added 275,000 U.S. jobs last month, which was larger than expected.

INTEREST RATE FUTURES

Fed Chairman Jerome Powell sticks to the script and says the Fed is data-dependent.

We look pretty close to fair on the interest rate curve right now and are light on positioning or in no-man’s land on a directional lean.

Key Takeaways:

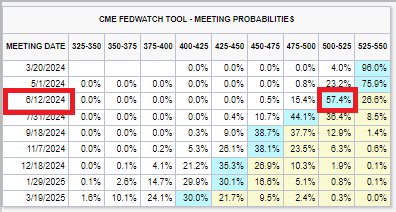

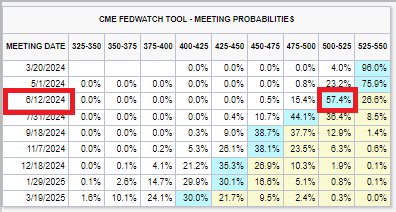

- Fed on Hold, Rate Cuts Priced for June.

- The market expects no rate change at the upcoming FOMC meeting on March 20th.

- Recession scenario? All bets are off.

- Powell reiterated a data-dependent approach, offering little guidance.

- Goldman Sachs forecasts first rate cuts for major central banks in June, but timing remains uncertain.

- Recent Fed speeches hint at a potentially higher neutral rate, impacting expectations for future rate cuts:

- This could mean the Fed stops cutting sooner than the dot plot suggests (above 2.5%).

- Adjust your strategies accordingly, especially those relying on a specific terminal rate.

Source: CME Group

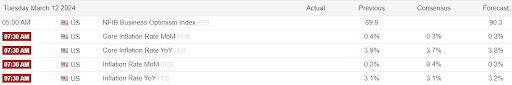

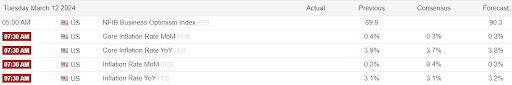

CPI INFLATION REPORT

Economists expect headline CPI to rise 0.4% month-over-month for February and Core Inflation (ex-food and energy) up 0.3%. Inflation is expected to show a 3.1% year-over-year increase for the month.

BITCOIN FUTURES

Bitcoin déjà vu at an all-time high? The last few days of BTC record rally and pullback echoes 2020.

Is history repeating? This past performance suggests potential volatility around the current all-time high. Keep an eye on price action in the coming days/weeks.

Key Takeaways:

- BTC hits a record high of $70,000 over the weekend but pulls back again.

- BTC mirrored its 2020 behavior, surging to a new all-time high of $69,290 last week before a correction to $59,246.

- It took two weeks for BTC to decisively break above $20,000 in 2020.

- In late 2020, BTC repeatedly tested the then-all-time high of $20,000, experiencing similar sell-offs:

- 16% drop after the first attempt.

- 10% drop after the second attempt.

GOLD FUTURES

After a lull, gold futures are back in the spotlight. Last week, a surge in trader interest drove gold to a record high above $2,164 per ounce.

A combination of factors fueled this rally, including hopes for interest rate cuts by the U.S. Federal Reserve, rising geopolitical tensions, and concerns about China’s economic slowdown. But the question remains: can gold sustain this momentum?

IPO

Breaking news for traders! Reddit, the social media platform synonymous with WallStreetBets (WSB), is going public!

Here’s the skinny:

- Price: $31 – $34 per share

- Market Cap: $6 billion – $6.6 billion (lower than the $10 billion valuation in 2021)

- Ticker Symbol: RDDT

- Exchange: New York Stock Exchange (NYSE)

Analysis for traders:

- This is a hot IPO, especially considering the history WSB has with influencing stock prices.

- The offering price is below the peak valuation, which could be an attractive entry point for some.

- But remember, Reddit is still losing money, so this is a high-risk, high-reward play.

MENTAL SIDE OF TRADING

Attention Traders:

Don’t slow yourself down by using words like “try” and “hope.”

Simply say what you will do when you will do it, and then DO IT!

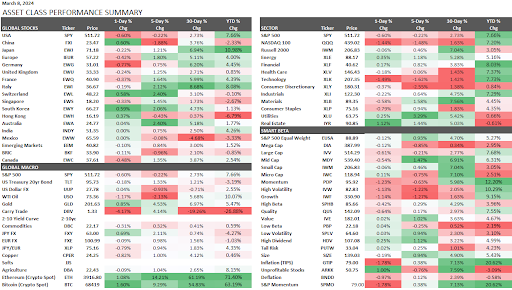

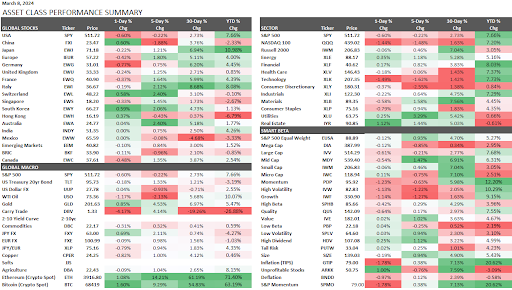

asset class performance sheet

These performance charts track the daily, weekly, monthly, and yearly changes of various asset classes, including some of the most popular and liquid markets available to traders.

All content published and distributed by Topstep LLC and its affiliates (collectively, the “Company”) should be treated as general information only. None of the information provided by the Company or contained herein is intended as (a) investment advice, (b) an offer or solicitation of an offer to buy or sell, or (c) a recommendation, endorsement, or sponsorship of any security, Company, or fund. Testimonials appearing on the Company’s websites may not be representative of other clients or customers and is not a guarantee of future performance or success. Use of the information contained on the Company’s websites is at your own risk and the Company, and its partners, representatives, agents, employees, and contractors assume no responsibility or liability for any use or misuse of such information.

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the investor’s initial investment. Only risk capital—money that can be lost without jeopardizing one’s financial security or lifestyle—should be used for trading, and only those individuals with sufficient risk capital should consider trading. Nothing contained herein is a solicitation or an offer to buy or sell futures, options, or forex. Past performance is not necessarily indicative of future results.

CFTC Rule 4.41 – Hypothetical or Simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, because the trades have not actually been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.