Home › Market News › Forex vs Futures: Trade Smarter, Not Harder

We get it, Forex trading made perfect sense when you started. Low barrier to entry, 24/5 market access, and the ability to start small with micro lots. What’s not to love? If you’re reading this, you might be looking for something different.

Here’s the thing: you’re not alone.

Forex markets are incredibly appealing to new traders, and we understand why. You can literally get in for next to nothing and begin trading the same day. The messaging around it these days makes it sound like a level playing field where your trading strategy and discipline are all that matter.

But here’s what you might not realize: you’re not just trading against the market, you’re trading against a system that might be working against you.

Think of forex trading like a flea market where every booth sets its own price. It’s decentralized and over-the-counter, which means there isn’t one “big store” where all prices are set the same. Instead, different brokers set their own prices, and those numbers can vary in a big way from place to place.

The spread problem is bigger than most traders realize. Bid-Ask spreads (the difference between the bid price and ask price) act like a silent tax on every single trade you make. In calm markets, they might seem reasonable. But here’s the kicker: spreads balloon right when opportunity strikes. When volatility hits and you want to capitalize on movement, that’s precisely when the distance to break-even stretches fastest.

You might be trading perfectly. Your analysis could be spot-on, your risk management disciplined, and your timing top-notch. But if spreads and execution consistently stack the deck against you, the ongoing costs can quietly eat away at your profits. It can feel like you’re running on a treadmill: lots of movement, but not much progress.

It can be frustrating to know you can be doing everything right and not have much to show for it. Support and resistance? Nailed it. Momentum and trend structure? You’ve got it down. Risk management? Handled.

But none of that matters if you’re juggling platform-to-platform price gaps and execution that works against you when markets move quickly. Before you know it, your funds are deeper in a hole than your strategy can dig you out of.

But when you trade through decentralized brokers, the game changes. Each broker runs on its own pricing feed, so the chart you’re trading may not be the chart someone else is trading. That means you’re not just trading the market, you’re battling gaps between trading platforms, phantom wicks that trigger stops, or delayed fills. You can read the market perfectly and still get clipped by the broker’s games.

The brutal truth? With forex, many brokers use this less-regulated system to take a piece of everything you make. That’s a conflict of interest that no amount of skill can overcome.

Here’s where it gets interesting. Professional traders aren’t battling these same issues because they’re not trading forex. They’re trading futures: a market built on transparency and fairness, where everyone plays by the same rules.

Think of futures like a transparent auction with one centralized exchange. It’s the same price for everyone. No mystery markups, no variable pricing depending on the platform, and no spreads that hit right when you need consistency most.

In futures markets, the structure itself works for you, not against you:

The mindset shift is important here: yes, forex lets you “get in for cheap,” but cheap entry isn’t the same as a fair playing field. When spreads and execution always work against consistency, those ongoing costs can make the “cheap” option the most expensive in the long run.

The good news? Those skills you’ve developed in forex can translate to futures with some small adjustments. Support and resistance, momentum, and trend structure still apply, and many traders think they play out even more cleanly in the futures market.

Think of it as translating terms: pips become ticks, lots become contracts, and pairs become products. Many traders start with familiar markets like euro or index futures, then branch into metals, energies, and rates as confidence grows.

Now, usually, when talking about futures, the immediate hurdle is pricing.

This is where Topstep shows up. Remember how forex’s main appeal was that low barrier to entry? Topstep gives you access to futures trading without needing to blow your car note payment on it.

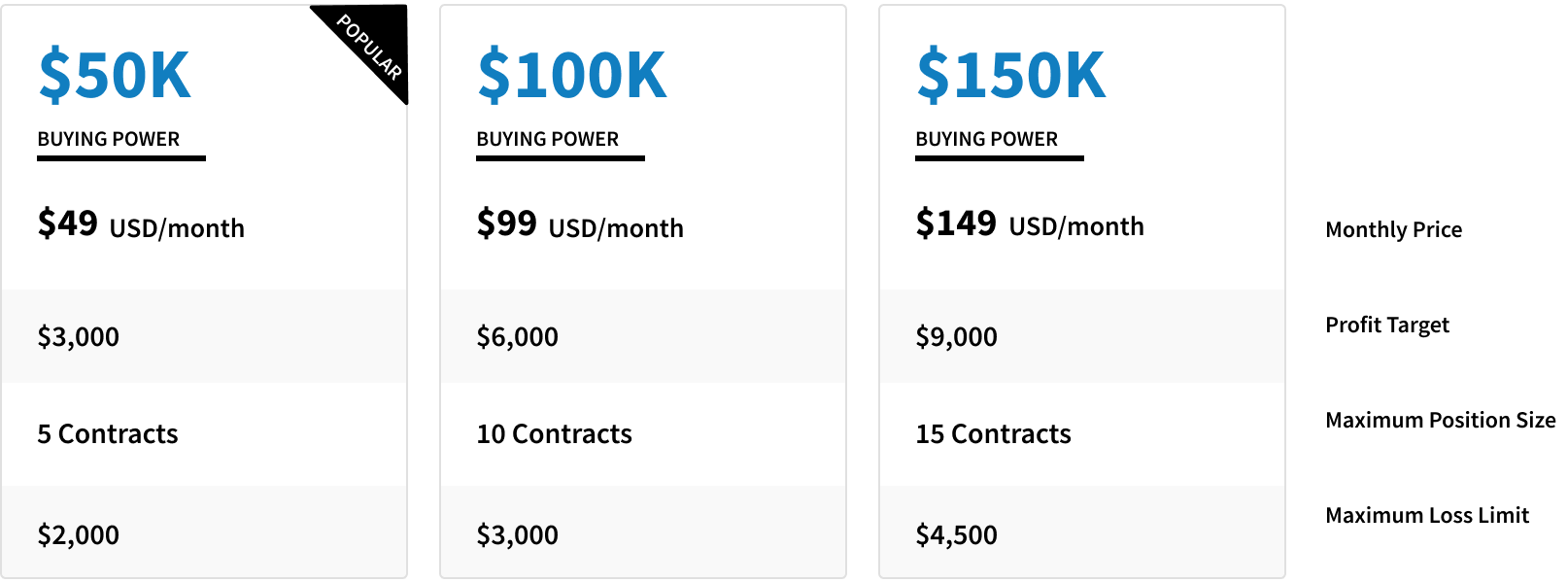

For only $50, you can purchase a trading evaluation, show us that you can trade, and earn up to 50K in buying power.

Yeah, 50 bucks. That’s it. Seriously.

Now here’s the part where I tell you how it works. Topstep is a prop trading firm that funds traders who can prove they know what they’re doing. It’s that simple. Instead of needing tens of thousands to trade futures, you just pay $50 for that trading evaluation we mentioned earlier, and show off your skills.

Show consistent risk management, hit your profit target, and boom, you can access an Express Funded Account, where you keep 90% of the profits.

Think of it like getting a tryout for the major leagues instead of grinding it out in the minors forever.

And if you’re still not sure, we have a platform designed to make it even easier to keep that momentum. TopstepX is built specifically to help traders get funded and stay funded. We’re talking next-level risk controls that don’t just protect your account, they actually build the winning habits that keep you profitable long-term.

This kind of setup is why more traders have been funded using TopstepX than any other platform we’ve offered. Every feature is designed around one clear goal: helping you build the right habits and earn real payouts. You’re trading in a simulated futures environment that mirrors real market conditions, but without the games you run into with forex.

No broker betting against you. No spreads that balloon right when you need them tight. No silent taxes eating away at your profits. Topstep takes the trading skills you’ve developed and gives you a fair playing field where consistency and risk management equal real results.

So yeah, forex markets promise easy access, but with Topstep, you have easy access and fairness. If you’re tired of fighting spreads, questioning whether your fills are fair, and wondering why good strategies aren’t producing results, it’s time to trade where the pros do.

With Topstep, you can make this transition with guardrails on, learning futures market structure, while working toward real funding at the same time. Your trading skills may not be the problem; the playing field is.

Time to switch to a market where your edge matters and you’re in control of your results.

Forex Pros

Forex Cons

Futures Pros

Futures Cons

Forex offers a low barrier to entry, 24/5 market access, and the ability to start small with micro lots, which makes it attractive for beginners.

Forex is decentralized, so brokers set their own prices. The bid-ask spread often widens during volatility, which increases trading costs and eats into profits.

Futures are traded on centralized exchanges with transparent pricing, predictable costs, and real market data, while forex is broker-driven and decentralized.

Futures provide fairness and consistency through one central exchange, with no broker markups or hidden spreads that can work against traders.

Yes. Core skills like support and resistance, trend analysis, and risk management carry over. The main differences are terminology and contract structures.

Topstep allows traders to access funded futures accounts by proving their trading discipline and risk management through an evaluation process.

Traders can begin with as little as $50 for a trading evaluation, which gives them a chance to earn up to $50,000 in buying power.

TopstepX is Topstep’s platform designed to build strong trading habits, provide real-time risk controls, and support traders in getting funded and staying funded.